For some people, the IRS and ERC credit can be a great way to get some money back on tax payments. But there are certain things you should know before you claim. You'll also want to find out about how much money you can claim and what you need to do to make sure you're eligible.

Statute of limitations

ERC, or Employee Retention Credit, is a tax credit designed to assist employers in retaining qualified employees. The credit is not repaid, but it does require the employer to make a few changes on their tax returns. A good way to avoid the headaches associated with filing a claim for ERC is to get the help of a reputable professional.

During the last few years, Congress has been making the rules for the ERC program more liberal. For example, the IRS has allowed employers to include wages paid to part-time employees in their calculation. In addition, the earned leave credit was extended to five years.

One of the most important aspects of the ERC process is the eligibility memo. This document is the first foothold in your credit claim. However, this is just one aspect of the ERC. You may also want to consult a tax professional to learn more about the ERC.

An ERC consultant can help you determine your eligibility and calculate your credit. They can also prepare you for an audit if the IRS finds your claim to be fraudulent.

It is also important to note that the Employee Retention Credit statute of limitations is longer than the three-year statute of limitations for income tax returns. That means you could miss out on a substantial amount of money if you claim the wrong ERC.

The best way to ensure you do not miss out on an ERC credit is to hire a good tax professional who has a thorough understanding of the program. If you don't, you could wind up with a penalty or repayment of the credit.

The IRS may need some extra time to review your claim and complete your tax return. That is why you need to consult a trusted professional and prepare contemporaneous documentation for your ERC claim.

Eligibility requirements

If you are a business owner who suffered a substantial loss due to the COVID-19 pandemic, you may qualify for the Employee Retention Credit. It is a refundable tax credit that can provide relief to struggling businesses.

The IRS has set aside some special requirements for severely distressed businesses. These include a loss of 90% or more and a full or partial shutdown of operations due to the government's directives. However, if your business has suffered a significant decline in gross receipts, you may also qualify for the ERC.

To be eligible for the Employee Retention Credit, you must first meet a number of requirements. Businesses that fall within these guidelines are entitled to up to $26,000 per employee. Moreover, companies must have a gross revenue for a qualifying quarter that is less than half of the amount that was received during the preceding calendar year.

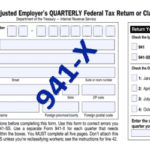

You must also file a Form 941-X with your federal tax return. This form will be used to calculate your credit. Once you have filed the form, you must submit it by July 2023.

In addition, you must complete an application that will be reviewed by the IRS. After the approval, the credit will be applied to future payroll taxes.

A professional can help you determine if your company qualifies for the ERC. They can also help you through the process of filing an application and claiming your credit. Before deciding to hire a third party, check that the fee is reasonable. Some companies are forced to pay a large upfront fee to a third party before receiving a refund.

As a result, it is important to seek professional legal counsel to avoid costly mistakes during the claims process.

Can be claimed on PPP loans

Employee Retention Credit, also known as ERC, is a tax credit offered to businesses that need help with employee retention. The IRS provides guidelines on PPP loans and the ERC.

Previously, businesses that received PPP loans could not claim the ERC. However, under the Consolidated Appropriations Act (CAA) of 2021, businesses can claim the credit regardless of whether they have a PPP loan.

In order to qualify for the credit, a business must meet certain criteria. For example, it must have qualified wages. These qualified wages must be earned between March 12, 2020, and September 30, 2021. This means that a business can claim the credit if it had employees earning at least $10,000 per quarter.

To claim the credit, a business must file an amended payroll tax return. Applicants should seek assistance from a tax professional or financial advisor to ensure they are making the correct claims.

In addition to qualifying wages, a business must also have other expenses that are eligible. For example, an eligible business must have a loan for utilities, rent, or business mortgage. Expenses must be reported separately from payroll costs. If the business has a PPP loan, it must report how much of the loan is used for these purposes.

Businesses should avoid claiming both a PPP loan and ERC. It can create duplicate expenses. Also, employers must track qualified and non-qualified wages. Qualified wages are those that are not recorded as payroll. Non-qualified wages are those that are not used to pay for payroll taxes or benefits.

Aside from this, the tax laws may change. For instance, a business can claim a tax credit if it has higher payroll expenses than it had previously.

Can be claimed after a pandemic

When it comes to claiming the IRS ERC credit, the small business owner is not alone. In fact, some advisory firms have even taken advantage of this golden tax break. Using this aforementioned aforementioned golden tax break as a launching pad, a cottage industry of advisory firms has sprung up. Some claim to be able to tap into this federal pandemic aid.

The ERC is a refundable tax credit available to qualifying businesses. As such, it is one of the more lucrative tax breaks on the books. ERC is a boon to small businesses looking to attract and retain employees during a time of national pandemic. Although, the program isn't exactly a panacea. It was designed to encourage small businesses to open doors – or at least keep the doors open.

For the record, the ERC has a small cap on the maximum dollar amount allowed. The CARES Act rolled out in March 2020 is responsible for the introduction of the Earned Revenue Credit. To qualify for the ERC you have to have partial or full shut down of normal operations. During the time period covered by the credit, the average business can expect to take home up to $26,000 in ERC refunds per employee. Aside from the aforementioned small business, nonprofits and other qualifying entities are also eligible. Those looking to take advantage of the ERC should be prepared to provide basic details about their company, including the size of their workforce and the type of trade they engage in. They may even be required to fill out a form 941-X.

The IRS is likely to make their decision on your ERC application in a timely manner. For instance, if you haven't completed your application by January 2, 2022, you may be able to take home a hefty tax bill.