Employee retention credit is a form of loan that is granted to employers who have met certain requirements. These qualifications include having a qualifying wage and having received a PPP loan or grant. This article will explain more about these qualifications.

Employers with COVID-19 directives

The Employee Retention Credit is a tax credit for qualified employers who have been ordered to stop operations due to COVID-19. Originally, the tax credit was only available to employers with over 100 employees, but it has expanded to include smaller businesses. This credit, which has been approved by the Internal Revenue Service, can help employers with payroll taxes.

The IRS has established a special section on its website dedicated to COVID-19 information. It also has updated FAQs on this topic. The agency has also provided additional guidance on workplace safety, vaccinations, and return to work rules.

Employers that are impacted by COVID-19 may be able to receive funds through a grant. These funds can be used to train workers for new roles or mitigate the effects of the outbreak. Applicants can work on private property, but they must justify the need for that. In addition, local workforce development boards should continue making on-the-job training reimbursements to employers.

Some of the most common questions about COVID-19 include how the payment of the Employee Retention Credit will be affected. As with any government assistance, employers must document their eligibility and ensure that they are in compliance with all federal and state laws. They can do this by providing the IRS with copies of completed Forms 7200 and 941.

A second type of credit is offered through the Paycheck Protection Program. ERC is an extension of the CARES Act, which means that eligible employers can obtain payroll tax credits for up to 50% of qualified wages paid to employees. Specifically, this credit is available to tax-exempt nonprofits, public and private institutions, and certain other eligible employers.

The CARES Act is aimed at improving the lives of Americans and includes several tax credits. These include the Employee Retention Credit and the Paycheck Protection Program. For more information, employers should check out the IRS's FAQs on the subject.

During a pandemic, it can be difficult to stay on top of payroll. However, employers with COVID-19 directives are now eligible for employee retention credit, which is part of the CARES Act.

Several federal and state government agencies are working to provide guidance for employers. Federal and state legislative bodies are considering legislation that addresses COVID-19-related issues. Businesses should check with an expert to ensure they are qualified for all government tax relief. If they aren't, they might want to request an overpayment or ask the IRS to correct their filing.

There are also several government tax relief programs that can assist qualified employers with payroll taxes. To qualify for these benefits, employers must file IRS Form 941 and 941-X within three years of their initial return filing. When filing, businesses must show their share of Medicare and social security taxes withheld from their employees. Moreover, they must provide a copy of their completed Forms 941/942 to the IRS.

Employers that received a PPP loan/grant

If you're an eligible employer that has received a PPP loan or grant, you may be able to take advantage of the Employee Retention Tax Credit. The credit is available to small businesses, nonprofits, sole proprietors, and veterans organizations. It can be used to cover payroll taxes and qualified health plan expenses. You can receive a refund of up to $33,000 per year.

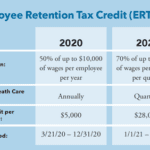

Originally, employers that took out a PPP loan or grant were ineligible for the ERC. But this changed in January 2021 when the IRS retroactively approved the credit for qualifying wages. However, businesses that have already paid back their PPP loans or grants will no longer be eligible for the credit. Instead, they can defer 50% of the employment taxes until December 31, 2021.

The Employee Retention Tax Credit is an incentive that can help businesses save up to $33,000 a year. Generally, it's applied to wages that were not worked during a period of business suspension. For example, if you had a company with 50 employees and a gross revenue of $100,000, you could receive a tax credit of $7,000 a quarter. In addition, the ERC can help you claim a refundable tax credit for any non-payroll costs, such as rent, utilities, operations, or certain health insurance expenses.

To qualify for the credit, you'll have to file an employee Federal Employment Tax Return and contribute to the gross compensation of at least one employee for the quarter in which you filed. Depending on your specific business, you might have to make additional contributions. All eligible expenses must be included on your application.

The credit is not available for self-employed individuals or self-employment services. Additionally, if you're a dental practice, you must experience a minimum of a 50% drop in gross receipts to qualify. Any furloughs must be included in the FTE calculation.

As part of the relief package, the American Rescue Plan Act expanded eligibility for the credit. Previously, only Recovery Startup Businesses could claim the credit. Now, all businesses in recovery are eligible. Even recovery startups no longer have to close.

Although some businesses are ineligible for the credit, most businesses have enough qualified wages to be eligible. The maximum refundable credit is $10,000 a quarter, and you can also claim up to 50% of your qualified wages. Depending on the number of employees you have, you can claim up to 70% of your qualified wages. When applying for the credit, you'll need to submit an online application and additional documentation. This includes photocopies of payroll ledgers and employment tax forms.

Unlike the previous relief package, the new relief package is retroactive. That means that it applies to salaries earned after March 12, 2020. So, if you have an eligible business that had a PPP loan, you'll be able to claim a credit on your salaries for up to five years.

Qualified wages for small employers

If you are a small business owner and you want to retain your employees, there is a tax credit you may be eligible for: the Employee Retention Credit. The ERC is a tax credit that you can claim against wages and health care expenses. A small employer can earn up to $5,000 in credits each year for each qualified employee.

ERC was initially designed to help struggling businesses during the COVID-19 pandemic. During this time, the government had placed restrictions on many businesses, making it difficult to remain open. However, the refundable tax credit made it possible for small companies to continue operating. In order to be eligible for the credit, a business must have fewer than 501 W2 employees in the qualifying quarter and show that its gross receipts have declined by at least 20%.

Businesses are not required to include qualified wages in their income when they file their federal income tax returns. However, the IRS does have a detailed FAQ on how to determine qualified wages. These wages are defined as wages that are paid to an employee when they are not providing services. Qualified wages also include portions of the cost of group health plans and pre-tax employee contributions. It is important to note that a small business cannot claim the ERC on wages that were used to obtain PPP loan forgiveness.

While there are still some limitations, the Employee Retention Credit is an excellent option for a small business looking to retain its workforce. Unlike the other small business tax incentives, the ERC offers a generous amount of money, which can often exceed an employee's normal earnings.

Although there are some differences in the eligibility rules for smaller and larger employers, the maximum amount of credit for any given employee remains the same: $10,000 per quarter. There is a similar limit on the total amount of credits that an individual business can receive each calendar year: $50,000. Also, the ERC is not available for wages that were paid after September 30, 2021. To qualify for the credit, a business must meet a number of other requirements. Specifically, a business must have been in operation before February 16, 2020 and have a significant decrease in its gross receipts.

The IRS has released several FAQs to answer any questions that may arise about the ERC. For example, the most recent FAQ provides some information on whether part-time or reduced-schedule workers are eligible for the credit. This FAQ does not have the force of law, however.

The ERTC is a refundable tax credit that you can claim against wages and healthcare expenses. You can claim this credit if you are an employer, income organization, or tax exempt entity. Currently, there are two ways to calculate the credit. First, the ERC is calculated on a percentage of total qualified wages. Second, the credit is apportioned among the members of an aggregated group.