If you have just started a company in 2023, you may be eligible for the Employee Retention Tax Credit (ERTC). As long as you meet the qualifications, you can receive a tax credit of up to $2,000 for each employee you retain. This can be useful in helping you grow your business. You can use it to offset the cost of hiring new employees and to improve your productivity.

Calculate qualified wages

If you have qualified wages, you can qualify for the Employee Retention Tax Credit. This credit is a tax incentive for employers to keep their employees on the payroll.

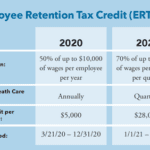

The ERC is calculated on a calendar quarter basis. You can qualify for it if your business pays more than $7,000 in a single quarter. You can claim the credit on your Form 941 and amended payroll tax returns. There are also certain limitations. Nevertheless, it is a great way to reduce your tax liability.

The Employee Retention Tax Credit was created as part of the CARES Act. It is not available to employees who are on paid family leave or who are working due to economic hardship. Also, you can't claim this tax incentive for wages that were used to defer Social Security taxes.

In order to qualify for the credit, you must have a work force of at least 100 full-time employees. Additionally, your qualified wages must be at least $10,000 per calendar quarter for 2021.

Depending on your business size, there are different rules. For example, if your organization has more than 500 employees, you will have to use a different method to determine your qualified wages.

Qualified wages are the difference between the pay and the hours worked. In addition to the salary, you can include health plan costs as a component of the calculation. When you calculate the amount of money you can claim, make sure you enter all the information accurately.

For example, the amount of the ERC must be reported on Form 941 for the quarter in which the credit is claimed. You can also take advantage of the credit by requesting an advance payment of your employment taxes.

There are also certain rules for businesses that have less than 500 employees. In addition to the ERC, you might want to consider the Work Opportunity Tax Credit. These credits are provided by Section 51 of the Internal Revenue Code.

Using an employee retention credit calculator can help you to determine your eligibility. If you need assistance calculating your qualified wages, contact an experienced tax professional.

Eligibility criteria

The ERC (Employee Retention Tax Credit) is an economic stimulus program that is designed to encourage employers to keep their employees on the payroll. It provides a refundable tax credit against employment taxes to businesses that have 100 or fewer full-time employees.

Designed to help keep employees on the job during difficult times, the ERC is based on the number of full-time employees and the wages paid to them. A full-time employee is defined as one who works at least 130 hours per month.

While the ERC isn't for everyone, many businesses have claimed millions of dollars in tax credits through the program. However, you should check with your accountant or a payroll specialist to determine if your business qualifies. If you do, you can claim a refundable credit of up to $26,000 for a single employee.

To qualify for the Employee Retention Tax Credit, a company must have a taxable gross receipts of less than $1 million annually. New businesses may be eligible as long as the gross receipts for the first quarter are lower than the prior year's figure. This can be determined by comparing the gross receipts for the prior quarter to the current quarter.

The CARES Act created the Employee Retention Tax Credit. The law specifically recognizes tax-exempt organizations as eligible employers.

ERC is a refundable tax credit that can be claimed against a variety of employment taxes. In general, the credit is equal to 50% of the wages paid to eligible employees during a specific period. However, it is not available to employees of state or local governments, family members of the business owners, or small businesses with less than $100,000 in payroll.

Whether you are looking to qualify for the ERC or you just want to learn more about it, you should contact an experienced legal counselor. A qualified attorney will be able to reduce your risks while preparing your claims. You can download an eligibility questionnaire to get started.

Once you have qualified, you will need to report qualified wages and pay related health insurance costs on Form 941. These records can be used to claim a tax credit in the future.

Deadline

Employee Retention Tax Credit (ERTC) is a tax credit available to eligible employers. It can be claimed against employment taxes and certain payroll expenses, such as health care. The program was designed to encourage small businesses to keep their employees on the payroll.

It is based on the wages of qualified employees. Businesses can claim the ERTC on their amended payroll returns. Applicants must meet specific eligibility criteria.

Eligible businesses can claim up to $10,000 per quarter. However, the maximum credit depends on the number of employees and wages paid. Generally, the credit is a dollar-for-dollar payment.

Small businesses that have received PPP loans can also claim the ERTC. This is because a portion of the pretax funds are retained by the employer. Nevertheless, this type of ERTC cannot be used to offset PPP loan funds.

Despite the many changes in the ERTC, there is still time to claim the credit. In fact, the deadline for this type of refundable tax credit has been extended from January 1, 2022 to October 1, 2021.

Employee Retention Credit was first introduced in the early days of the COVID-19 pandemic. The program was meant to give extra incentive to small businesses that were struggling with the economic impact of the disease. Many employers were severely financially distressed during the pandemic.

During the CARES Act, a new refundable tax credit was created for the small business community. Employers with fewer than 500 employees can qualify for the ERTC program. Moreover, they can receive a $26,000 tax credit.

Since the CARES Act has been signed into law in March 2020, there is a good chance that this relief will continue until December 2021. However, this does not mean that companies can't claim it retroactively. They can, however, do so only if they have a record of their gross receipts being reduced.

Before making a claim, an employer should understand the unique impact of the ERTC on its business. There are a number of factors to take into account, such as the number of employees and the complexity of their claim. As a result, it is best to take a little time and carefully document their decision points.

PPP forgiveness report

It's important to know what information to include on the PPP Forgiveness report. In this article we'll go over the major changes for both the 2020 and 2021 programs. There is also a strategy that can help you maximize your benefits from both.

The IRS has provided guidance on the new rules. The guidance clarifies the relationship between the Paycheck Protection Program (PPP) and Employee Retention Credit (ERC). This is especially helpful if you have questions.

Notice 2021-20, issued on March 1, 2021, is a 102-page document that addresses a number of questions taxpayers have had about the two programs. It provides examples to illustrate the complex issues.

If you have a PPP loan, you must show you used at least 60% of the total loan on payroll. You also have to show you haven't double dipped. Depending on your eligibility, you can report up to 40% of the loan amount on non-payroll expenses.

When filing for PPP loan forgiveness, you must include all eligible expenses. These include wages, utilities, rent, mortgages, and other expenses. Depending on your eligibility, you may be able to claim tax credits for additional payroll costs.

If you have more than 500 employees, you may be able to file for an advance refund of your anticipated credit. Similarly, if you have less than 500 employees, you can request a refund on Form 941.

If you are applying for PPP loan forgiveness, you can report up to 40% of the total loan amount on non-payroll costs. However, the IRS makes clear that eligible expenses not included on the loan forgiveness application cannot be factored in after the fact.

If you have a PPP second-draw loan, you can claim the ERC before your loan is forgiven. File an amended 941X form for the first quarter to claim the ERC.

Both the PPP and the ERC are meant to provide for employees and small businesses. They are designed to give relief to those who are facing hardship. A smart strategy is to maximize your benefit from both programs.