The IRS ERC is a program that allows many individuals to be exempt from paying taxes on their income. It also allows for the exclusion of some income from gross income. There are several considerations that people need to take into account when figuring out if they are eligible for the program.

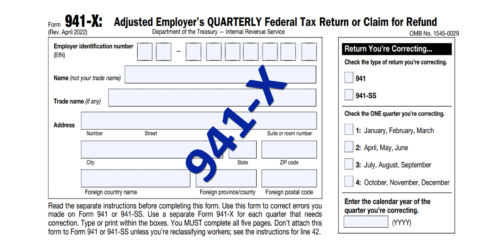

Form 941-X due date

Whenever an employee discovers an error in an IRS Form 941, he or she must file a 941-X to correct it. The due date of this form depends on the period during which the error occurred. If the employee discovers the error during the first quarter of the tax year, the Form 941-X due date is in the first month after the quarter. Similarly, if the error is discovered during the second quarter, the Form 941-X is due in the last month of the year.

Aside from repairing tax errors, the Form 941-X is also used to claim a refund. However, the IRS does not allow this to be done online. Instead, taxpayers must send the form via postal mail. This method does not incur any penalties or interest.

In order to claim a refund, you must file a Form 941-X within two years after the date you paid the tax. It is important to note that the date of filing the form will depend on the underreported tax amount. You may also have to pay penalties if you do not file the form within the time frame.

Before submitting your Form 941-X, you need to make sure that you have the right information. These include your company's name, address, and an EIN number. Also, you need to explain the reason for the corrections on the form.

When claiming the employee retention credit, you must use the form to amend your Form 941. This is the easiest method of claiming the credit. Nevertheless, it requires you to submit all the relevant documents, including the original Form 941. Similarly, you also need to provide the IRS with a copy of your payroll logs.

The IRS has created a chart that provides a high-level overview of the line items that you need to be aware of. For instance, you need to know the amount of the non-recoverable element of the COBRA premium support credit. And, you must know the amount of the credit for qualified sick and family leave wages.

You also need to understand the other forms associated with a refund, such as the ERTC. The ERTC is easy to claim as long as your records are accurate.

Exclusion from gross income

If you are an employer, you may qualify for the Employee Retention Credit (ERC). ERC helps reduce the amount of federal employment taxes that you owe. The credit is based on the percentage of wages that an employer pays to its qualified employees before January 1, 2022. An employer can claim an ERC for every qualified employee or the entire payroll. A maximum credit of $10,000 is available per calendar year quarter.

However, it is important to understand the rules for this credit. The IRS has released a series of FAQs and guidance to help clarify the process for claiming ERC.

In addition, there are a number of conditions that an employer must meet to qualify for this tax credit. These include having less than 10 percent of the total employees employed in the State, operating as a recovery startup business, having an average annual gross receipts of under $1 million, and starting operations after two days.

Another important factor to consider is the exclusion from gross income of forgiven PPP Loan amounts. This is provided under the Taxpayer Certainty and Disaster Tax Relief Act of 2020. It is important to consider this when calculating the ERC because it affects the taxpayer's ability to demonstrate a decline in gross receipts.

To qualify for the ERC, an employer must exclude the forgiven loan amount from its gross receipts. It is important to note that this exclusion does not result in a basis increase. Depending on the circumstances, it may not be worth it to exclude the loan amount from the taxpayer's gross receipts.

The Employee Retention Credit can be very beneficial to many employers. However, it is important to remember that it can be used to lower federal employment taxes, but it cannot be claimed against the Medicare or Social Security tax. Employers with more than 500 employees are eligible to claim the ERC in 2021.

The CARES Act, which passed the legislature in March, 2020, extended the ERC through the end of 2021. As part of the CAA, the IRS issued notice 2021-49 to address questions raised by the tax code.

Impact on state income taxes

The Employee Retention Credit (ERC) is an employee tax credit. Designed to encourage employers to keep their employees on payroll during the Covid-19 crisis, the credit isn't just a cash rebate – it's a fully refundable federal tax credit. This credit is one of the most generous in the country, with an annual benefit of up to $5,500. It can be used by both large and small employers, as long as you are in business.

Fortunately, the IRS has provided some helpful guidance on how to take advantage of the ERC. For starters, the IRS has issued a new notice (not to be confused with a previous notice) that will help you claim your ERC credit. In addition, it has released a new IRS Tax Guide for Small Businesses, which provides an overview of the ERC and its most relevant provisions. You'll find detailed information on all aspects of the credit, including eligibility criteria, payment requirements and other important details.

One of the most exciting aspects of the ERC is that it can exceed the amount of actual payroll taxes you are required to pay. That's because the ERC can be claimed on a per employee basis. Employers are not only able to claim a credit for each qualifying employee, but they may also claim a one-time credit for each qualifying employee that was retained on the books.

To make things even better, the ERC is part of the CARES Act. This legislation, passed in March of 2020, will provide a $15 billion Economic Injury Disaster Loan (EIDL) grant to the Small Business Administration (SBA) and the Federal Emergency Management Agency (FEMA). While the grant is a big deal, the actual ERC may be more important, as it's designed to encourage businesses to continue their operations during the ongoing Covid-19 crisis.

A number of California employers are likely to take advantage of the ERC in the coming year, which means that the IRS will need to do its best to get them to file their information returns in a timely manner. If you're interested in learning more about the ERC, the Tax Guide for Small Businesses can be found at www.ci.cal.ca.us/tax/guides.

Loans based on ERC eligibility

An employee retention credit (ERC) is available to eligible employers to reduce the amount of employment tax they owe. This credit can be up to $28,000 per employee. However, the number of qualifying wages that can be claimed is limited. The credit is valid for as long as the government order that allowed it is in effect.

The ERC was originally instituted to help businesses survive the outbreak of the coronavirus. In order to qualify, an employer must have incurred significant disruption in its business operations during the period of the government order. Currently, the maximum reduction in gross receipts is 20%.

However, many employers are overlooking this requirement and may be eligible for the ERC without a substantial revenue decrease. The IRS has developed guidance to help businesses interpret this new requirement. Specifically, the IRS has published a Notice 2021-20, which explains how both the PPP and the ERC work together.

Businesses that have received PPP loans are now eligible for the ERC. Before, only organizations that did not receive PPP loans were eligible for the credit. It is also now available to certain nonprofits, and it is applicable retroactively.

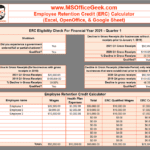

To determine if an employer is qualified to claim the ERC, they must first calculate the total amount of their payroll costs. They then compare the amount of the cost of qualified payroll to the cost of qualified nonpayroll costs. If the total of the cost of qualified payroll and qualified nonpayroll costs is greater than 60%, they will be able to claim the ERC.

Once an employer is qualified, the IRS will issue an advance payment to them. The advance can be used to pay payroll taxes, or it can be deposited into a designated account. Employers with 500 or fewer employees can use an ERC advance.

However, the tax credit must be reported on Form 941-X. The advance can be up to $28,000 for the entire year. Moreover, a maximum of $10,000 can be claimed each quarter. Therefore, the total maximum credit that an employer can claim each quarter is $28,000.