The employee retention tax credit has recently been extended until 2024. If you are an employer who is considering investing in your company, you should consider all of the options available to you, including this credit. However, you have to be sure that your company meets the requirements for the credit.

Qualified wages

Whether you are a small business, a large employer, or a startup, you can qualify for the employee retention tax credit. However, you need to understand the eligibility rules for this program, as well as how much you can claim. You can get more information about this credit on the IRS website.

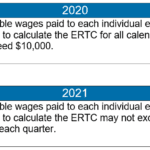

The Employee Retention Tax Credit is available to eligible employers who pay qualified wages to their employees. Qualifying wages are defined as wages subject to FICA taxes. Qualified wages include wages for employees not working due to closure, wages paid for sick days, allocable health plan expenses, and wages that are allocable to certain medical expenditures. It also includes payments made to terminated workers.

The IRS has several ways to calculate the amount of credit you may qualify for. For example, the credit may be computed based on the total qualified wages paid to eligible employees. In addition, it can be based on the number of full time employees.

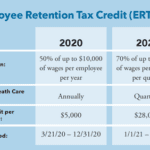

To be eligible, you must have less than 501 W2 employees in the qualifying quarter. For the 2020 tax year, you can claim a credit for up to $5,000 per employee.

This program can help your business recover from a pandemic. But you must prove that your gross receipts have decreased at least 20 percent during the calendar quarter. Your business may also qualify if you have been closed because of a COVID-19 mandate.

Employee Retention Tax Credit is not a loan, but rather a reimbursement by the government. It is available to businesses with qualified wages and a governmental order that required partial or complete shutdown.

To be eligible, you must file Form 941-X, which is short for Modified Employer's Quarterly Federal Tax Return. It is also possible to claim this credit retroactively.

Eligibility requirements

Employee Retention Tax Credit (ERTC) was created as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The ERTC is a tax credit, not a loan, that will allow employers to claim an amount of up to 50% of qualifying wages paid to employees during a specific period of time.

This credit is designed to help businesses keep employees working, and it is offered to companies with 100 or fewer full-time employees. In order to qualify, businesses must have gross receipts that are lower than 10 percent of comparable quarters in both 2019 and 2020.

Businesses may also qualify for the credit if they have been closed due to a government directive regarding the COVID-19. This could include quarantines, travel restrictions, or other business interruptions.

ERC today has a plethora of resources to assist with evaluating your company's eligibility for the credit. They offer guidance on the process, as well as expert program knowledge.

There are several different types of businesses that qualify for the credit. Some examples are non-profits, self-employed individuals, and organizations that received PPP loans. While these companies are not eligible for the credit, they can still take advantage of the other provisions.

For most businesses, the most important consideration is whether or not they qualify. The IRS offers a safe harbor, which allows employers to calculate eligibility based on their previous quarter's gross receipts.

There are some special requirements, as well. Businesses with annual gross receipts of less than one million dollars qualify for the credit. Recovery Startup Businesses are also eligible, but they will have to meet certain criteria.

Lastly, the maximum amount of money that an employer can claim is $10,000 per employee. However, the IRS states that the maximum credit can be reclaimed over a six-to-ten month period.

Impact on your business

The Employee Retention Tax Credit is one of the tax benefits that helps encourage employers to keep their employees and businesses open. Specifically, this tax credit allows eligible employers to deduct a percentage of qualified wages, up to a maximum of $10,000 per quarter.

Businesses that are interested in taking advantage of the Employee Retention Tax Credit should start by researching their potential eligibility. Depending on the size of your company, you may be able to receive a large refundable tax credit or a smaller non-refundable credit. There are several factors that affect the credit amount you are entitled to, including the number of employees, the type of business and the gross receipts your business generates.

As you work to determine your eligibility, you should be aware of the latest changes in the law. Specifically, there have been two significant changes in the law that impact the credit.

First, the CARES Act changed the way businesses can claim the ERC. Instead of being based on a specific time period, businesses can now claim a credit for the period of the pandemic or any impacted days, as long as the day is recorded on a form 941 or other tax filing.

Second, the ACA expanded the definition of a full-time employee. It defines a full-time employee as someone who works at least 130 hours each month.

Finally, there is a change that will apply to the credit in 2021. In addition to the new rule, there is a reduction in the maximum credit limit from $28,000 to $21,000. Whether you are a large or small company, the ERC is still a great incentive to retain employees and stay on track with your business's operations.

Extended to December 2021

Employee Retention Tax Credit is a refundable tax credit for small businesses, specifically those with less than 100 employees. It helps businesses offset payroll taxes owed by up to $7,000 per employee, per quarter. This is an incentive for businesses that struggle to keep their employees in place during difficult times.

The CARES Act extended the employee retention tax credit through December 2021. In addition, the American Rescue Plan Act extended the credit through the first three quarters of the year. However, these changes won't have a huge impact on the total credit amount.

Despite these new limits, the ERC remains a refundable tax credit for employers. Until the end of 2021, businesses can claim the credit if they file Form 941 for the appropriate quarters. If they don't, they will have to wait for the statute of limitations to expire.

For eligible businesses, this credit is well worth the effort. Not only does it allow companies to retain employees, it also gives them a chance to save money on social security and Medicare taxes.

Although the IRS offers guidance on the employee retention tax credit, it's not always easy to determine if your business qualifies. You can find the official IRS guide to the credit on their website, and you can also contact your local office for help.

In addition to the employee retention tax credit, the American Rescue Plan Act also allows small businesses to take advantage of the Paid Leave Credit. Small businesses can now qualify for up to $28,000 for the entire year.

The CARES Act also includes the ERTC, which provides a refundable tax credit for up to $10,000 in wages each quarter. While it's not as popular as the ERC, the ERTC is still a useful tax incentive.

Can I claim the employee retention tax credit on a PPP loan?

Employee Retention Tax Credit was created by Congress to help businesses retain employees during a pandemic. It provides assistance to businesses that had to suspend operations or reduce their payroll. The credit is based on wages paid to all employees who were not working during a period of declining gross receipts.

Businesses that are eligible to receive PPP loan forgiveness can also apply for the ERC. However, they must meet SBA requirements. Applicants will be required to demonstrate that they spent at least 60% of the loan on payroll and non-payroll costs.

PPP loan applicants can also claim the ERC retroactively. They must determine which time period is best for them. You can choose between an eight-week or 24-week period.

The credit is available to both small and large businesses. You can file for it through Form 941-X. An application form is required and additional documents must be submitted with the application.

In order to qualify for the ERC, you must have a loss in gross receipts during a period of business suspension. This includes companies that were shut down due to the COVID-19 outbreak. Depending on your business, you may be able to claim up to $28,000 per employee per year.

If you do not qualify for the ERC, you can still apply for PPP loan forgiveness. PPP loans are forgivable on principal, but they must be paid back. Using funds to repay your loan may incur additional costs.

The PPP loan has a fixed interest rate of 1%. Loans may be up to $10 million. There is a five-year repayment plan. Employers can use 40% of the loan for other expenses, including health insurance.