ERC Credit 2023 – What You Need to Know

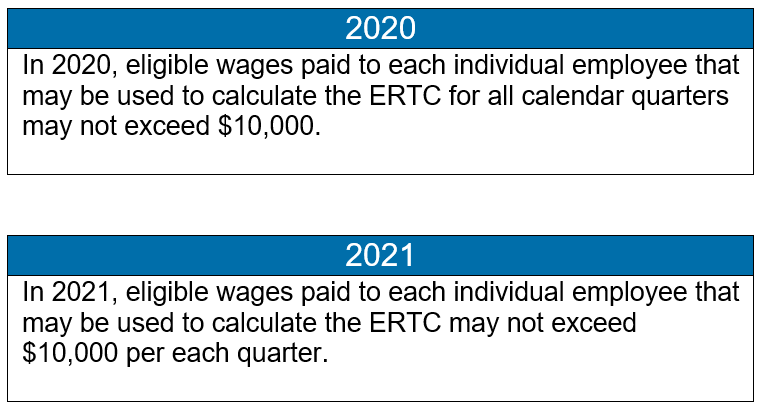

The ERC credit 2023 is available for certain ERICS and ERCA programs and is a great way to reduce your tuition costs and help your career. However, there are a few things to know about the program and the deadline to apply. Refund in the form of a grant The Earned Revenue Credit (ERTC) is […]

ERC Credit 2023 – What You Need to Know Read More »