The ERC credit 2023 is available for certain ERICS and ERCA programs and is a great way to reduce your tuition costs and help your career. However, there are a few things to know about the program and the deadline to apply.

Refund in the form of a grant

The Earned Revenue Credit (ERTC) is a refundable payroll tax credit that provides cash relief to businesses. It is calculated on wages paid during an eligible period. ERTC is available for qualified employers who have experienced a significant decline in gross receipts.

ERC is designed to help employers keep employees on the payroll. If a business has more than 100 full-time W-2 employees and has suffered a significant decrease in gross receipts, it may qualify for the ERC.

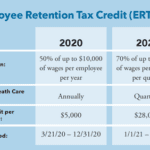

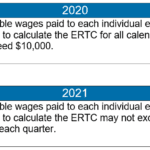

Employers can claim the credit on Form 941. The credit is applied against the federal payroll tax liability of the employer. An employer who qualifies can claim the credit on up to 70 percent of qualified wages. For example, if the employer pays $30,000 per quarter and the quarterly average wage is $6,000, the ERC can be as high as $26,000.

The IRS has issued guidance for the ERC in 2021-2022. These guidelines, called Notice 2021-49, provide taxpayers with a general overview of the ERTC for the year and provide details on how it will apply.

The CARES Act is a key piece of legislation that has led to the introduction of the Earned Revenue Credit. This new credit is calculated on wages paid between March 13, 2020 and September 30, 2021. Businesses that qualify for ERC will be able to receive a refundable refund in the form of a grant of up to $28,000 for the year.

To claim the credit, employers must complete and file an amended payroll tax return. The IRS generally gives businesses two years to make changes. If a company makes an improper ERC claim, it will face penalties and interest.

If a business is eligible for the ERC, it is advisable to take steps to maximize the amount of the credit. One such strategy is to calculate the number of qualified wages.

Employers may also claim the credit against the wages of employees who work part-time. However, a business with more than 100 employees is required to apply for safe harbor. Safe harbor will require that the gross receipts of all entities for the quarter be at least 20% less than the previous quarter.

Eligibility criteria

The ERC tax credit is a credit available to employers for qualified wages. This credit is available to all businesses. If you are eligible for the credit, you can claim it on your payroll taxes. There are a few important factors that you need to know when claiming it.

Firstly, you can only claim the credit for qualified wages paid during a suspended period. For example, if your company is partially suspended for reasons related to COVID-19, you can claim the credit. However, you will only qualify for this credit if your business received orders from an appropriate governmental authority to suspend operations.

Also, you will need to prove that your gross receipts decreased by at least 20% in the quarter that you are claiming the credit. You will also need to include documentation of qualifying techniques and expenses.

If you have a small company, you may be able to claim the credit for all wages paid to employees. Larger companies must qualify under more specialized criteria.

However, the maximum benefit that you can receive is limited to $21,000. This is the maximum for both the 2021 and 2020 programs. In 2021, the benefit is only available for the first two and third quarters.

You can claim the credit for wages paid before January 1, 2021. However, you must have been a business for at least six months. When applying, you must submit Form 941-X, which is part of the quarterly federal tax return. A 60-second eligibility quiz can help you verify your eligibility.

Lastly, the amount of the ERC credit is often larger than the payroll taxes that you are paying. Therefore, it is advisable to seek legal advice. If you do not qualify for the credit, you can request a refund from the IRS. It is also a good idea to keep all records related to your grant, including the time and dates that the grant was used.

While you are assessing your eligibility, remember that ERC Today offers a range of services and tools that will help you evaluate your claim. Their experts will provide you with a complete analysis and guide you through the entire claim process.

Documentation required

If you're considering filing an ERC tax credit application, you may have questions about the documentation required. You'll need to provide basic information about your company, such as the number of employees, gross receipts, and revenue.

The IRS has published a handy document on March 1, 2021, that answers several commonly asked questions about the ERC and the PPP. This includes the ERC's eligibility requirements and the most efficient way to claim the credit.

While the IRS has a fairly standard process for ERC applications, there are some nuances to the program. In particular, businesses that pay their employees via third-party payers can qualify for the ERC. However, some companies claim they're eligible without providing quantifiable evidence to support the claim.

Some businesses will claim the ERC because of a government order, such as the COVID-19. For example, a business is able to claim the credit if the order caused a significant drop in gross receipts.

To claim the ERC, you'll need to complete Form 941-X, which is part of a quarterly federal tax return. A business that receives funds from the Paycheck Protection Program can also claim the credit.

The ERC is designed to assist small businesses. It helps offset the costs of keeping key personnel in place during tough economic times. There is a maximum amount of credit available to qualifying employers: $21,000.

You can qualify for the ERC if your business pays its employees a wage that meets a certain criteria. For example, you can claim the credit if the employee earned at least $10,000 in the previous quarter.

The IRS has put out a helpful document called Notice 2021-20. This 102-page document explains the various aspects of the program, including the ERC's eligibility requirements and the best ways to claim it.

If you're thinking about applying for the ERC tax credit, you may want to consider enlisting the assistance of a specialist. These experts will ensure you have the proper documentation to prove you qualify. They'll help you determine which credits are most beneficial to your business and make sure you get the credit you deserve.

Deadline

The Employee Retention Tax Credit (ERTC) is designed to help businesses retain their employees. It is a tax credit which pays businesses for wages paid to their employees. These credits are available to both small and larger companies.

To qualify, businesses must be affected by the COVID-19 pandemic, and gross receipts must have declined by at least 50%. Small businesses are eligible for the credit as long as they are paying at least 100 full-time employees.

Employers must file Form 941-X on a quarterly basis. If they do not, they are subject to a penalty of 10% of the amount of payroll taxes withheld. Businesses that fail to deposit these payroll taxes are also subject to penalties.

Before you submit your Form 941-X, you should determine the exact number of qualified wages. This will be the basis for calculating the amount of your credit. Generally, the credit is 50% of the wages, but you can increase this by up to 70 percent if you are paying wages of $10,000 or more.

If you are unsure about your eligibility for the ERC, you can verify your eligibility by taking a 60-second quiz from the IRS. Alternatively, you can consult an adviser to help build a defensible position for your claim.

You can claim the credit for wage payments made between March 13, 2020 and December 31, 2020. In addition, you may qualify for the credit if you had payroll tax withheld for the fourth quarter of 2021. Your credit will expire on January 1, 2022. So it's a good idea to make a quick assessment of your eligibility for the ERTC while you still have time.

Once you have determined whether your business is eligible, contact Aprio for assistance. They have a team of specialists who can work with your company to retroactively claim the ERC for 2021 and 2022. And they can help you apply for an advance payment from the IRS. Regardless of your business's size, ERTC is a great opportunity to help offset costs of keeping employees. Apply today!

Ultimately, the CARES Act was created to give businesses more flexibility to keep employees and retain them. By extending the ERTC through 2021, the CARES Act provides businesses with a way to help keep their workforce on the job.