The Employee Retention Credit is a great tax break for employers. It provides an incentive to retain employees and improve productivity. This credit can be claimed on up to 20% of your employee's first year of employment. To claim it, you need to calculate the total cost of employee retention, subtract that cost from the amount of tax you pay to your employees, and submit the amended tax return.

Calculating the credit

The Employee Retention Credit is one of the most important tax measures for small businesses. This credit provides instant financial relief for businesses. However, the program is available only to qualifying businesses. Consequently, it is crucial that companies know whether they qualify.

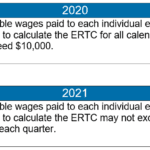

To be eligible for the credit, an employer must have paid wages for at least 100 full-time employees in a calendar year. Qualifying employers may claim the credit for the first three calendar quarters of the year. A qualified employee must work at least 30 hours per week. For example, a company with three full-time employees would be eligible to receive $15,000 in ERC salary.

In addition, eligible employers must also report the total of their qualified wages on quarterly employment tax returns. If the amount of qualified wages reported on the quarterly return exceeds 80% of the total qualified wages reported on the same quarterly return in the prior year, the credit will be credited.

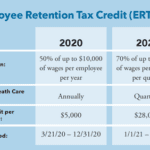

Unlike other payroll credit programs, Employee Retention Credit does not have a cap on the number of employees. Nevertheless, it does have a maximum credit amount. The maximum credit for the entire year is $28,000.

The Employee Retention Credit is designed to reward employers who are struggling to maintain their workforce. This credit is available to qualifying employers, regardless of business segment, annual turnover, or size. Moreover, the credit is refundable, which means the amount owed by the employer is refunded to the company.

Employers who have received a PPP loan are also entitled to the ERC. It is also possible to retroactively apply for the credit.

During the fourth quarter of 2021, the Employee Retention Credit has changed. Employers who want to calculate it should make sure they have the right tax records. These should include payroll, capital expenditures, and health care expense information. Moreover, the same wages used in the calculation cannot be used for the purpose of seeking forgiveness of a PPP loan.

In general, the employee retention credit has been expanded. Now, a qualifying employer can claim up to $7,000 per employee in a quarter.

Substituting 2020 for 2019 as the comparison year

The Employee Retention Credit is a tax break for retaining and retraining employees at risk of retrenchment due to a lack of job security. To qualify for the tax break, a company must first prove that it can demonstrate it can sustain an acceptable level of unemployment. This can be accomplished through a combination of measures such as paid sick leave, subsidized health care costs, and other forms of employee assistance. Despite these efforts, companies can still lose jobs to nimble competition and even outsourced workers. Fortunately, the government has a few tricks up its sleeve.

One of the best ways to test a company's mettle is to compare its gross receipts in Q1 of 2021 to those of Q4 of the same year. Using this information to your advantage is the best way to maximize the tax credit available. Depending on the size of your operation, your gross receipts may be in the single digits, which is why the employee retention credit is one of the most lucrative tax breaks available to a savvy employer. With such a tight market, a savvy exec will likely have no problem squeezing out the best deal possible. In the end, this is a win-win situation for both the employer and the government. It may also help to keep a close eye on the number of open positions in your employ. Similarly, keep a tab on your payroll tax to avoid a slap in the face should your favored employee leave on a whim.

Filing amended tax returns

The Employee Retention Credit is a tax credit that can be claimed by businesses against certain payroll taxes. It is also refundable. This means that the refund can be paid directly to the employer. In most cases, this credit will be higher than the amount of payroll taxes that the business has paid in the credit-generating period.

There are a number of guidelines that employers should follow when claiming this credit. These include guidance on the statutory requirements and the health plan expenses that are eligible. For additional information, you can visit the official IRS website.

To claim the ERC, an employer must file amended tax returns for the taxable years in which qualified wages were paid. These returns must be filed within three years of the due date.

In addition, a tax-exempt organization that claims ERC must include a reduction to the amount of its wage expense. An employer that claims ERC must also include a reduction to the amount of its health insurance expenses.

To determine the amount of ERC that you can claim, you should start with the Form 941-X instructions. This form includes two worksheets that help you to calculate the ERC that you can claim.

You must also verify the boxes on lines 2 and 5d in part 2 of the form. You will need to use this Form for every corrected Form 941 you file. Using this form will allow you to correct overreported taxes.

If your business is a pass-through entity, you will also need to amend Schedule K-1. Pass-through entities must issue amended Schedule K-1s for any individual shareholders that claim the credit. Using this form will avoid filing individual income tax returns for each partner.

To claim the ERC, you must file an amended federal income tax return for the taxable year in which qualified wages were paid. You can claim up to $7,000 for each employee for each quarter.

Although the law is in effect, you must not submit your amended tax return until you have completed your calculations. This may cause cash flow issues for your business.

Getting immediate compensation

Employers are able to take advantage of a refundable payroll tax credit. This credit encourages firms to keep people working and on payroll during periods of high unemployment. It is available to businesses that have experienced a significant drop in revenues in the past quarter.

Employers can reduce payroll taxes by filing amended 941 returns for each quarter. However, there are certain eligibility criteria for getting immediate compensation for employee retention credit. In order to qualify, a business must have been a small employer. These businesses are allowed to claim a credit of up to $7500 per employee. The amount of the credit depends on how many employees the company has.

Employee Retention Credit is a program that was introduced by the United States government. This program provides financial relief for companies affected by COVID-19. Businesses with gross revenues below 80% of the average quarterly payroll for the same quarter in 2019 are eligible to apply for this credit.

Employers with up to 500 full-time employees may claim the credit. They can also use the qualified wages of employees who are not performing services for the employer. Qualified wages include salary, compensation, and share of career health care costs. Wages paid to employees for vacation, sick days, or other days off do not count as qualified wages.

For qualifying employers, the maximum credit is $28,000 in 2021. If the total credit exceeds the amount of the qualified wages, the excess is refunded to the employer. A company can also receive an advance payment from the IRS. To get instant compensation for employee retention credit, an eligible business can file an amended 941 return for the quarter in question.

Businesses with over 500 full-time employees can only claim the credit for the wages of employees who are not performing services for their employer. Eligible wages are the salaries, compensation, and share of career health care cost of all employees. During periods of business suspension due to governmental order, qualified wages are paid.

The American Rescue Plan Act made changes to the Employee Retention Credit program in March of 2021. This legislation gave companies additional financial opportunities and provided a more streamlined process.