The employee retention tax credit can be a valuable business tool to assist them retain their employees during difficult economic times. The Coronavirus Aid, Relief created this refundable tax credit in addition to the Economic Security (CARES) Act in 2020 and is designed for employers to ensure that they keep their employees on payroll in spite of the financial challenges caused by the COVID-19 virus. The tax credit for employee retention is available to companies regardless of size, including those that are self-employed or have less than 500 employees.

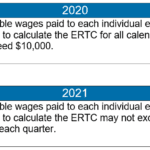

The employee retention tax credit provides a refundable tax credit for up to 50% of the wages paid by an eligible employer to its employees over the course of the year beginning at March 12, 2020, until December 31st, 2021. The maximum amount available for the credits is $5,000 per employee for the year. The credit is accessible to employers regardless of whether they've had to endure a total or temporary suspension their businesses due to the COVID-19 epidemic.

The goal of this article is to provide an overview of the employee retention tax credit, and the things employers need to be aware of in order to be able to get the benefit. We will discuss eligibility requirements, how it is used, and how to claim the credit. We will also offer tips for employers on maximizing their employee retention tax credit.

In conclusion, the retention tax credit is an effective option for employers in helping retain their employees in hard economic times. The tax credit is accessible to all employers and grants a tax credit of up 50 percent of the wages that an eligible employer pays its employees. Employers should take time to be aware of the requirements for eligibility and how the credit operates and how to take advantage of it in order to maximize the tax credit for retention of employees. By taking advantage of this tax credit, employers will aid in ensuring their company's financial stability and their employees' continued employment.

Additionally, employers must consult their tax advisors to ensure they're making the most of the tax credit and other relief programs. It is important to note that the CARES Act provides a number of other relief programs to go along with the tax credit to retain employees which include Paycheck Protection Program, Paycheck Protection Program and Economic Injury Disaster Loans. Through taking advantage of all of the relief programs offered employers can aid in ensuring the financial stability of their companies and their employees' continued employment.