There are several different ways that an employer can claim the ERCC tax credit. One of them is through the use of payroll adjustments to the employees. Another way is through the employee retention credit.

Employee retention credit calculation

Employee retention credit is one of the best tax measures for small businesses. It is a refundable tax credit that lowers payroll taxes and encourages employers to retain employees.

Before implementing employee retention credit calculation, an employer must know the eligibility requirements. Depending on the nature of the business, the amount of the credit will vary. The credit is fully refunded when the employer pays the full tax owed. This tax credit was introduced under the CARES Act.

Aside from reducing payroll taxes, the employee retention credit also minimizes the number of workers who apply for unemployment benefits. There is no limit to the total amount of this tax credit. As long as the company meets the eligibility requirements, it can apply for it.

The Employee Retention Credit Calculation is available to qualified employers, public colleges and universities, and healthcare organizations. To calculate the credit, employers can perform a Wage Register report and filter down to the appropriate pay items. Once a company knows its ERC eligibility, it can file an application with the IRS.

If the organization meets the eligibility criteria, then it is required to submit an accurate employee retention credit calculation report. The report will include qualifying wages for each individual employee. In addition to the amount of the credit, the report will also include the income tax benefits earned by the company during that year.

Another important factor to remember is that an employee retention credit is only valid for two years. Therefore, employers should take advantage of the credit while they can.

In addition to the Wage Register report, the employee retention credit calculations also require the appropriate calculation of the related health insurance expenses. Qualified wages are those that include salaries, commissions, tips, and other compensation subject to FICA tax. However, the amount of the ERC is not equal to the full Social Security liability.

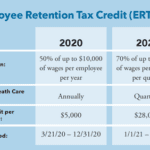

The employee retention credit was created to help employers deal with income crises. It initially was calculated as a credit of 50% of the qualified employee wages. But, it was later expanded to 70% in 2021.

Employee retention credit for personnel adjustments

If you are an employer, you may be eligible to claim the Employee Retention Credit for personnel adjustments. This tax credit is intended to help employers retain their key employees when times are tough.

Eligibility to claim the ERC is determined by several factors. First, the employer must have had a significant decrease in gross receipts. Second, the business must have been operating for at least 10% of the quarter. The number of employees and total hours of service must also be considered.

Employers with under 500 full-time employees are subject to different rules. Businesses with more than 500 employees are only able to claim the ERC for wages paid during non-working periods.

To claim the ERC for personnel adjustments, the business must have had a significant reduction in gross receipts. In addition, the company must have had a full or partial shutdown due to COVID-19.

The ERC program is administered by the Internal Revenue Service (IRS). There are various ways to calculate the amount of the credit.

The amount of the credit can vary, depending on the type of third party payer and the number of employees. A third party payer includes a reporting agent or a payroll service provider.

An eligible employer must file Form 941-X, which is a quarterly federal tax return. Instructions for claiming the Employee Retention Credit are included in the form.

The IRS estimates that reimbursement of the credit will take six to ten months. However, there are procedures to make an interest-free adjustment for the prior quarter. It is best to work with an accountant or a payroll specialist to ensure that your business is eligible.

For additional guidance, go to the IRS website. Also, consult an attorney and a certified public accountant. They can provide you with answers to your questions and minimize risk during the claims process.

Although the webpage may not be up to date, it provides general information. You can use the ERC assistant to check your eligibility. When making a claim, be sure to follow the rules and procedures.

If you have any questions or concerns about the Employee Retention Tax Credit, you can contact the IRS.

Employee retention credit for businesses affected by travel restrictions

The Employee Retention Credit was a tax relief program created by the CARES Act. This credit is designed to help businesses get back on their feet and keep their employees from leaving. It provides a cash reward for businesses that have experienced an economic hardship due to the COVID-19 pandemic.

This credit is available to all eligible employers. Generally, a business can qualify for up to half of the wages that they paid to employees during the quarter. However, different rules apply for employers with less than 100 employees and large employers.

To qualify, a company must satisfy the business operations suspension test. This is usually done by demonstrating a reduction in gross receipts during a calendar quarter. Alternatively, an employer may use a Paycheck Protection Program loan to qualify for the ERC.

In addition, the IRS has released several notices outlining ERTC rules. These include Notices 2021-20, 2021-23, 2021-49, and 2021-65. They are not meant to be a legal authority, but they are an attempt to answer the dozens of questions that have been asked since the legislation was passed.

Although the FAQs don't cover all the important points, they do show the IRS's thinking on a wide range of questions. While these answers can't be used in court, they can be a good starting point for any company looking to take a reasonable position.

As far as the actual claim goes, the IRS estimates that the ERC will reimburse companies between six and 10 months after the date the credit was claimed. A small business that qualifies for the credit can receive a grant of up to $26,000 per employee.

If you are interested in the ERC, make sure to visit Aprio's dedicated ERC team. Our experts are national thought leaders on the COVID relief program and can answer any questions you have about the ERC. Also, don't hesitate to take a 60 second quiz to see if you are eligible.

While the Employee Retention Credit is a great way to help businesses recover from the pandemic, there are still many questions about the details. There is no one size fits all solution.

Employee retention credit for businesses affected by commerce disruptions

Employee retention credit is a tax credit that businesses can apply for during a time of commerce disruptions. If your business has suffered a significant decline in revenue, you may be eligible for the credit. There are a few requirements to qualify. Whether you are a small employer or a large corporation, the rules for eligibility are simple.

In order to qualify, your firm must have experienced a substantial decline in revenue during the quarter. Your gross receipts must have dropped by at least 20 percent. For example, if your gross receipts were at $200,000 in the fourth quarter of last year, your firm will qualify for the credit if your revenues fall by more than 20 percent in the fourth quarter of this year.

During the early days of the COVID-19 pandemic, 1.4 million manufacturing jobs were lost in the U.S. Many businesses shuttered their doors, lowered staffing levels, and reduced hours. Others, such as restaurants, closed completely. The food and beverage industry had a difficult time surviving due to a lack of customers.

During the COVID-19 lockdown, many hotel rooms were empty. Restaurants had to alter their hours to accommodate the shortage of guests. A number of states also had indoor dining bans. This affected the supply chain and delayed deliveries. It also caused a major drop in consumer spending.

While the government's directives on COVID-19 were not a payroll expense for PPP debt forgiveness, it does affect the business's eligibility for the employee retention credit. Businesses that were affected by the government's orders are encouraged to use the credit to help their business rebuild and get back on its feet.

To qualify for the credit, your business must have at least 50 full-time employees in the United States. You can claim a credit for up to 50% of your employees' wages, up to $10,000 in total. However, your firm cannot claim ERC on its wages for the years 2020 and 2021. Nevertheless, if you qualify for the credit, you will have instant cash relief for COVID-19-related expenses.

For more information on establishing your eligibility, read on.