If you are planning to claim the employee retention tax credit, there are some important things you need to know. These include how to calculate a loss, how to fill out Form 941-X, and how to claim the credit retroactively.

Calculate loss in gross receipts

For many businesses the best way to go about retaining their employees is to retrain them on the job. While the cost of training an employee may seem prohibitively expensive, the costs can be well worth the reward. The resulting savings in wages can mean a much smaller payroll tax bill. In the long run, a retrained employee will be more productive and less likely to look for greener pastures. Likewise, a well-trained employee will be a happier worker, which in turn results in better customer service and an improved bottom line. Fortunately for small business owners the government is on hand to help. With the enactment of the COVID-related Tax Relief Act of 2020, employers can take advantage of the benefits of a modernized workforce. As a result, more and more small businesses are able to compete with the big dogs. Of course, the only catch is that many of these companies will be small in size. But thankfully, the IRS has a solution to the problem in the form of the Small Business Employment Tax Credit (SBETC), which provides tax breaks for companies with fewer than 500 employees. Moreover, the credit is paid out in quarterly installments, so you don't have to worry about getting hit with a lump sum.

To be eligible for the SBETC, you must check a box on line 18b of your Form 941. Other than that, it's a fairly simple process. For many small businesses, this is the first time they've had the opportunity to receive federal financial assistance. Moreover, the amount of money you'll be able to save can be significant, so you'll be able to use it to improve your bottom line. However, it's important to note that you'll need to pay attention to the fine print. Specifically, the amount of the credit will depend on the size of your company and your location, so make sure to double check.

Fill out Form 941-X

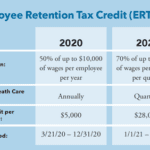

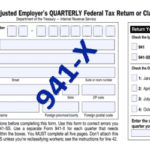

Regardless of whether you're an employer, self-employed person, or a student, you may need to fill out Form 941-X if you want to correct or receive a refund of an overreported amount. This is a form used to adjust employment tax credits, including the Employee Retention Credit. The ERC is a tax credit that can be claimed by employers who've suffered a reduction in gross revenue due to a coronavirus pandemic. It's available for qualified wages that were paid after March 12, 2020.

Employers who are eligible to claim the ERC can do so by filing Form 941-X for the year that they paid a worker. However, they must be careful not to make mistakes in calculating the amount of the ERC. Using the wrong withholding table or incorrect treatment of payments can cause an employer to withhold the wrong amount. If this occurs, an employer needs to recalculate the amount of the employee's share of the social security tax for the quarters in which the error occurred.

For example, an employer can incorrectly report the amount of federal income tax that was withheld from an employee's bonus. To correct the mistake, the company will need to reclassify the employee and withhold the correct amount of tax. In addition to withholding the taxes, the company will also need to certify that the W-2 that was provided to the employee was accurate.

Regardless of the reasons you're claiming an overreported amount, you'll need to provide a written consent from each of the workers involved. You'll also need to describe how the overreported tax was caused. Depending on your circumstances, you might be able to abate the amount, apply an interest-free adjustment, or file a refund claim.

When you're filing Form 941-X, you'll need to include any other applicable section 3509 rates. You'll also need to enter the original reported amount and the difference between the two columns. After doing this, you'll need to enter the total corrected amount for all employees.

Depending on your situation, you'll need to use the instructions on Form 941-X, line 18. Whether you need to amend the amount you've reported, or need to make a payment, you'll need to follow the instructions on line 18.

When filing Form 941-X, you'll also need to indicate the calendar year. The calendar year can be entered on pages 2-5.

Claiming the credit retroactively

The Employee Retention Tax Credit, or ERC, is a tax credit designed by the IRS to help certain businesses retain employees. It can provide a refund of up to $26,000 per employee, and a business can claim it retroactively. This credit can be claimed using an IRS Form 941-X. However, there are some important steps to follow.

First, a business must understand how a claim works and what it includes. If a business does not know what a Claim for Refund means, it is a good idea to hire an accountant to explain the process. There are two types of claims – nonrefundable and refundable. Nonrefundable claims are limited to certain taxes, and refundable ones aren't. A claim can only be revoked with the IRS's consent.

Second, there are two variables that determine whether an employee's wages qualify for the credit. These are the employee's salary and the amount of social security tax paid by the employer. Using this information, an employer can claim the ERC by filing a Schedule R and completing the requisite IRS Form 941.

Third, an employee's qualified family and sick leave wages are considered to be a tax credit. They can be claimed on an updated Form 941-X. Also, a business must file a schedule R to report a deferral of an employer's share of social security tax. Finally, if a business pays social security tax through federal tax deposits, it may not be eligible for the ERC.

When preparing a Form 941, a business owner needs to remember to check the box for “Claim” on the appropriate line. In addition, the business must include the following: the qualified wages of the employee, the qualified health plan expenses allocable to the qualified sick leave wages of the employee, and the qualified Medicare taxes allocable to the qualified sick leave income. Similarly, a business must include the social security tax contribution for the employee, as well as the employer's social security tax contribution.

The ERTC program is a little confusing to many businesses. To ensure compliance, a business should contact a tax attorney.

Verifying the IRS mailing address

There are a number of things you should know about how the Internal Revenue Service handles the Employee Retention Credit. During tax season, it's important to keep track of your tax returns and contact the IRS if you have any questions. However, it's not always clear what you should do if you have questions about whether your return was filed or if the IRS has your current mailing address. The IRS provides a number of FAQs on its website that can help you with your question.

If you've received a phone call from the IRS, there are several things you can do to protect your personal information. For example, you can never give out your name or login information to the IRS. You can also avoid phishing emails by ensuring you use a strong password for your account. In addition, you should check the IRS's policy for privacy. It describes your rights under the Privacy Act of 1974, Title 26 United States Code Section 6103, and Title 26 Code of Federal Regulations Part 301.

The IRS has also recently posted a Frequently Asked Questions section on its website, which can answer many of your questions. However, you should be aware that a Frequently Asked Question is not a legal authority and it cannot be used to support a legal argument in court. Also, the IRS's mailing address is not always consistent, which may make it difficult to get ahold of your tax agency. Depending on the time of day you're calling, you could wait up to 60 minutes to talk to a customer service representative.