If you are an employer, you may be wondering how to maximize the amount of federal tax credit you can receive for employee retention. There are a few things you need to know, like how to file, what the reportable expenses are, and what the Statute of limitations is. By knowing these things, you can ensure that you receive the maximum tax credit possible.

Form 941-X

If your business pays federal employment taxes, you should be able to claim a tax credit. The Employee Retention Tax Credit is one of the credit options available. However, this type of credit requires some understanding of the process and the requirements. Fortunately, if you have a payroll specialist on your side, you should not have too much trouble claiming it.

As with any type of credit, there are several guidelines and restrictions. For instance, the IRS may require you to substantiate your calculations before approving your application. Also, the credit is only refundable if the employer's Social Security tax contributions were paid.

To claim the ERC, you must complete an updated Form 941-X and include all necessary documents. In addition, you must explain the ERC on Page 5 of Part Four of the Form. It also must be signed. Once you have done this, you must mail it to the address listed on your account.

There are a number of parameters that go into determining the ERC, but one of the most important is the qualified health plan expenditures. You can report qualified health plan expenses on Line 31 of Form 941-X.

Another important item is the COBRA premium support tax credit. This is a tax credit for qualified employees who are receiving qualifying sick and family leave earnings. Typically, you are able to claim the credit for up to three years from the time that you first start monetizing the credit.

When it comes to estimating the ERC, you should keep in mind the PPP rule. Basically, you have 30 days to estimate the ERC. But this can be difficult because of the many restrictions.

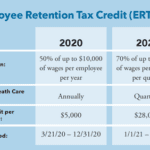

One of the easiest ways to estimate the ERC is to take the number of qualified wages you paid in each calendar quarter and multiply it by the credit percentage. For example, if you had five employees and paid them each $5k in the third quarter of 2019, the ERC would be calculated by taking the total of the five qualified wages and multiplying them by 50%.

Eligible expenses

Employee Retention Credit (ERTC) is a tax credit available to eligible businesses. ERC is claimed on Form 941, which is a quarterly payroll tax return. The credit amount is equal to a percentage of qualified wages. It is a refundable credit, meaning that the IRS will pay the credit to the employer.

A business must have paid its employees during the quarter in question. To calculate the credit, the business must determine the number of full-time employees. In addition, the business must also report total qualifying wages. Qualified wages include the allocable portion of qualified health plan expenses.

In the United States, an employee is considered a full-time employee if they work at least 30 hours a week. Employees who have qualified family leave wages are excluded from the definition of a full-time employee.

In order to claim the credit, an eligible employer must have paid the wages of at least 70 percent of its employees during an eligible quarter. An employer may receive $7,000 per employee in the fourth quarter of 2020 and the first quarter of 2021.

An employer can claim the Employee Retention Credit for taxable salaries received from March 13 to December 31, 2020. This credit is also available to religious organizations that experience significant decreases in gross receipts.

The American Rescue Plan Act (ARPA) extends the credit through the end of 2021. However, there are some limitations.

If an employer is a portfolio company under a fund, they are considered a separate trade. For these companies, there is an ownership family restriction that makes estimating the credit difficult.

Employee retention credit is not available to a business that is subject to the federal government's partial shutdown. However, an eligible business can claim it for a period after the governmental order has been lifted.

A qualified employer must report qualifying wages on their Form 941. The wages are calculated using several factors. The wages are considered to be qualified wages if they are subject to FICA taxes. As of November 17, 2021, 2.4 million Forms 941 are outstanding.

Statute of limitations

There is no single correct answer to the question “when should an employer amend their Form 941 to claim the employee retention credit?” Rather, the answer depends on your business and your industry. But generally speaking, an employer should claim the credit by filing an amended Form 941 at least ninety days before the end of the year in which it was earned.

This is because the employee retention tax credit is fully refundable. That is, the IRS will refund the monies if your clients fail to repay the credit. The credit is not a loan, but rather a percentage of the wages you pay your employees. To claim it, you must have employee consent. However, some taxpayers may not have obtained the necessary consent from their employees.

It can be difficult for payroll tax departments to keep up with the changes in the law. If you aren't using the latest Forms 941 or Schedule R, you may be missing out on some key employment tax credits. Therefore, it's vital to review your past Forms 941 to make sure you don't have any unclaimed credits. You can also work with your accountant or a payroll tax professional to find out which tax credits you may be eligible for.

Although the statute of limitations for an employee retention credit is a definite three years from the date of filing, it isn't long enough to claim it for all eligible wages. In addition, some of the tax credit is only available for 2020 and 2021 wages.

The Form 941-X (amended form) is a great tool to fix underpayments and to correct other errors. While it isn't meant to replace Form 941 or Schedule R, it can be useful to fix administrative errors that are causing underpayments on federal income tax withholding. Another option is to file a new Form 941-X to report the omission on Form 941.

The new Form 941-X contains a couple of nifty line items that should be on any payroll tax practitioner's must-have list. In particular, the new Form 941-X is the only form that allows you to report and display qualified health plan expenses.

Reporting requirements

The Employee Retention Credit, also known as ERC, is a tax credit for employers that covers pre-tax contributions from the employer and wages from employees. It is designed to provide companies that have lost gross revenue due to a coronavirus pandemic with a refundable credit.

This credit is claimed on Form 941-X. If the credit exceeds the amount of payroll taxes withheld, the IRS will refund the excess to the employer. In order to claim the credit, the employer must submit the eligible salary and qualified health plan expenditures on Line 30 of Form 941-X.

If you have any questions about this credit, you can get tax advice from a professional. Meaden & Moore agents can help you understand the credit in your particular situation. They can also assist you with submitting your Form 941-X.

You must file Form 941-X within three years after the date of your original filing. This will enable you to repair non-administrative errors on the form. However, this will not be able to correct any inadvertent errors.

Before you can file Form 941-X, you must certify that you have been paid all your Social Security taxes for the previous calendar year. This includes the 6.2% Social Security tax that was paid with your original Form 941.

Employers that have missed their deadline to report the ERC on their Forms 941 will be able to still claim the credit on their Form 941-X in 2021. Companies that have misclassified people will have to follow the instructions on line 42 of Form 941-X.

The American Rescue Plan Act has changed the process for reporting the ERC. Specifically, the credit percentage has been raised to 50% or 70%. As a result, it has become difficult to estimate the amount of the credit.

Many businesses struggle with this process. Fortunately, the Internal Revenue Service has published an initial draft of Form 941-X in preparation for the credit. Despite this, experienced tax experts may find it difficult to estimate the ERC.

The IRS has also posted guidance to help clarify the reconciliation process. Businesses should use this information to reduce inaccuracies.