The Erc credit 2022 is a new tax credit that is applicable to qualified health plan expenses paid for the purposes of obtaining or maintaining employment. The IRS has outlined how you can claim the tax credit, including if you are in the qualifying income range.

Qualified wages

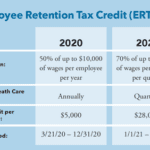

Employee Retention Credit (ERC) is a program designed to help employers retain employees. The ERC allows a credit of up to 50% of qualified wages, which is the money a company pays to an employee.

To qualify, an employer must have more than 100 full-time employees. It also helps to have the proper documentation in order to receive the tax credit. This can be done by filing an amended Form 941. Applicants must also prove the amount of qualified wages they paid.

The credit is not limited to wages that are paid after March 13, 2020. Qualified wages are defined as compensation that meets the requirements of section 3121(e) of the Internal Revenue Code. These include employee salaries, health care expenses, and related costs.

A credit of $7,000 per eligible employee per quarter in 2021 is the maximum allowed. Employers with less than 500 full-time employees can claim up to $5,000 in credits in the same year. If a business is eligible for ERTC, it can report its total amount of qualified wages on its second-quarter Form 941.

While the credit is not available to all businesses, it does provide a small boost to those that are in the unfortunate position of having to lay off employees. It can also be claimed by small businesses that closed because of the COVID-19 pandemic. However, if you are a startup business, you should consult with a tax professional before claiming a credit.

The Employee Retention Tax Credit is not only a way to help keep workers on the payroll, it can also serve as a way to make payroll taxes more affordable. Companies that have qualified for the program can offset their employment tax deposits to receive a credit.

A small business can claim the employee retention credit for wages they pay before January 1, 2021. Businesses that have experienced a large decrease in gross receipts can get an advance payment from the IRS, which can be used to cover some of their payroll taxes.

The Employee Retention Tax Credit is a great incentive for companies to stay on track during challenging times. In addition to the credit, the IRS has issued FAQs to help employers with the process.

Repayment of advance payments

The repayment of advance payments on a ERTC can be a daunting task for many employers. With no ambiguity, this is where a specialized financing group can shine. Not only will a dedicated financing guru help you wade through the maze, they can also give you the peace of mind that comes with knowing that your employees are getting a better deal than they would if you left it to chance.

Repayment of advance payments on an ERC can be done via a few methods. Among the options are a traditional payroll deduction, an ERTC loan or a combination of both. There are many factors to consider before selecting one of these methods. To be sure, the best option will depend on your business needs and budget. You should also ask your treasury personnel for guidance. For example, some companies will be happy to pay a small sum of cash to receive their ERC sooner rather than later.

On the other hand, if you are considering using an ERTC loan to fund your payroll, you will probably be required to make quarterly deposits in order to avoid penalties. As a result, the aforementioned senate-sized paycheck may be a distant memory by the time you are ready to claim your aforementioned tax break. Thankfully, the IRS has provided guidance in the form of an ERTC loan comparison chart that can help you make the right choice for your business.

While you are at it, do not forget to keep your eye on the prize: your employees. It is important to remember that while your employees are a source of pride and a source of income, they can become a liability if they do not pay their taxes on time. In fact, the IRS will penalize taxpayers who fail to make required deposits. Thus, the best course of action is to ensure that you make all of your deposits in a timely manner. Likewise, do not forget to recalculate your tax liability on a regular basis to avoid any surprises down the road.

Using an ERTC loan can help your business get on the right track sooner rather than later. Using the best lender for your specific needs can make the difference between a successful claim and a failure.

Reimbursement of qualified health plan expenses

The tax law provides employers with the opportunity to claim credits for the reimbursement of qualified health plan expenses. These credits can be claimed in addition to wages.

Qualified health plan expenses include the amounts paid by an employer to provide group health plans. Examples of group health plans include onsite medical clinics, self-insured and fully insured plans, health flexible spending accounts, and wellness programs.

IRS recently issued new FAQs that clarify how to claim the credit for qualified health plan expenses. The changes will help to encourage employers to continue paying these expenses for their employees.

Employers will be allowed to claim a credit for health plan expenses that were incurred during a significant loss in business. Previously, the IRS said that these expenses were not eligible for the credit. In response to a letter from members of Congress, the agency reversed its position.

An employer can receive the credit for 50% of the health plan expenses, 50% of the health care premiums, and 50% of the allocable health plan expenses. While contributions to Health Savings Accounts and Archer Medical Savings Accounts are not included in this calculation, some employer contributions to FSAs may qualify.

For example, an employer with 100 employees pays $1 million in annual premiums. Of that amount, $300 is considered as part of the employee's wages. However, the remaining $700 is not included in the calculation.

The statute of limitations for the ERC for 2020 is not closed until April 15, 2024. This means that employers will be able to claim a credit in 2021. If the employer has less than 100 employees in 2021, he or she can claim the ERC for the wages of the next calendar year.

In addition, a business can take advantage of a tax credit for qualified wages if the business has fewer than 500 employees. Small employers can also receive tax credits for the contribution of HRAs. It is important to note that this tax credit is only available to small employers.

There is also a tax credit for the expenses of employee health plans when the employee is not working. This is called the Employee Retention Credit.

IRS safe harbor

The IRS safe harbor 2022 is a method for making estimated tax payments. It allows you to avoid penalties for underpayment. However, you will have to estimate the amount you owe. You can hire an accountant to help you figure this out. If you expect to owe $1,000 or more, you will have to make estimated tax payments four times a year. You can pay online or in person. Depending on your state, you may also have to pay a penalty.

Before making your estimated tax payment, you will need to know whether you qualify for the safe harbor. For example, if you have a spouse who is married, you will have to have their previous year's adjusted gross income of at least $75,000. High-income taxpayers will need to have their adjusted gross income of at least $150,000.

Whether you qualify for the safe harbor is based on three factors. Your expected taxes for the current year, the percentage of the prior year's adjusted gross income you had, and the size of your gross receipts. Using the safe harbor will reduce your underpayment penalty if you don't meet all of the other criteria.

If you don't qualify for the safe harbor, you will need to pay 90% of your total estimated tax. In addition, you will have to make your quarterly estimated tax payments. These estimates are due January 15th, June 15th, September 15th, and December 15th of each year.

A de minimis safe harbor can allow you to deduct amounts paid to acquire tangible property. This is especially helpful if you have small businesses. You can also deduct expenses related to maintaining your books and records.

De minimis safe harbor is available for items that cost less than $2,500. This includes materials and supplies, as well as standby emergency spare parts and rotable spare parts. To use this option, you will need to include a statement with your federal tax return. Unlike other safe harbors, de minimis safe harbor doesn't require you to capitalize qualifying de minimis acquisitions.

If you qualify for the safe harbor but are not eligible for the de minimis option, you can still deduct amounts paid for tangible property. You may deduct these amounts up to $5,000 per invoice.