If you have employees that you want to keep, you might be interested in claiming the Employee Retention Tax Credit (ERTC). It is a tax credit that you can claim for retaining workers. There are some stipulations that you must follow in order to be eligible to claim the credit. You also need to know the limits of the credit and the filing requirements.

Employee Retention Tax Credit (ERTC)

Employee Retention Tax Credit is a program offered by the IRS. It is designed to encourage businesses to retain employees during economic hardship. There are certain restrictions to ERTC that businesses should be aware of.

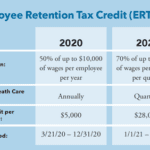

Businesses must have suffered a significant decrease in gross receipts. Gross receipts must be less than 50 percent of the same quarter in the year before. The maximum credit is $7,000 per quarter.

Employee Retention Credit is not available to government employers. However, non-profit organizations and small businesses are eligible. Employers must report their total qualified wages. They must also submit related credits, such as Social Security and Medicare taxes.

For the first three quarters of 2021, eligible companies can receive a tax credit of $21,000 per employee. If the business experiences a partial business shutdown, the claim can be made on the ERTC. A restaurant that has experienced a 20% decrease in gross receipts can request a $7,000 tax credit per employee for the remainder of the year.

Employee Retention Tax Credit is refundable. As a result, the tax credit can be used to offset the employer's share of Social Security taxes. Companies must keep records of grant use. Funds must be used for eligible uses by June 30, 2022.

While ERTC has been extended twice, the statute of limitations for 2020 and 2021 claims do not expire until April 15, 2024 and April 15, 2025, respectively. This means that businesses that did not claim the credit have three years to file an amended tax return or Form 941-X.

The ERTC is available to eligible businesses with fewer than 500 full-time employees. Eligible businesses may also request an advance payment from the IRS. The advance must be repaid by the due date of Form 941 for the quarter in which the claim is made.

Eligibility requirements

The CARES Act created an Employee Retention Credit (ERC) and it helps to keep employees on the payroll during times of crisis. It is a refundable tax credit equal to half of the qualified wages. ERTC can be claimed by businesses of all sizes. But how do you determine if your business qualifies?

First, you must determine if your employees are eligible. Basically, you must have an employee-based salary structure. You can use payroll information from a previous year or consult with a business solutions provider.

You can also compare your gross receipts in the first and second quarters of 2021. If you don't qualify, it's time to consider a new strategy.

The CARES Act has created a variety of benefits for small businesses. In addition to the ERC, there is a SVOG grant program that provides funds to eligible businesses to help retain employees. However, funds can only be used for eligible uses by June 30, 2022.

Another useful ERTC rule is the safe harbor. This allows businesses to claim the ERC without having to prove that their gross receipts have actually decreased in a calendar year.

This is important because in the past, many business owners assumed they were ineligible for the ERTC because their income had not declined more than 50%. While this isn't necessarily true, the safe harbor should be applied across all entities.

Depending on your business model, you may be able to claim the ERTC for wages that were paid after March 12, 2020. And for those companies that are still in operation in 2020, it might be a good idea to file an amended Form 941x to claim the credit.

Filing requirements

The Employee Retention Tax Credit (ERTC) is a tax credit that can reduce the amount of taxes that you pay. It helps small and medium-size businesses keep their employees on payroll. However, there are some filing requirements that you should take note of.

In order to qualify for the credit, you must have fewer than 500 full-time employees. The average full-time employee is defined as an individual who works at least 30 hours a week.

You will also have to file a form 941. This is a quarterly federal tax return. Depending on your business' size, you may be eligible to claim a credit of up to $26,000 per employee.

You can claim the credit on a percentage of wages, or you can get a check. To determine whether you qualify, you should consult an accountant or tax professional. If you have questions about the credit, visit ERC Today. They will guide you through the process and provide a free consultation.

While there are some limitations on the ERTC, it can be an excellent way to keep your employees on the payroll. Also, the credit is completely refundable. As long as you pay back any advanced funds by the due date for your Form 941, you won't have to worry about paying any penalties.

The IRS recently released guidance on the ERTC. The agency clarified the definitions and documentation requirements, as well as some other unanswered questions. These changes were made in response to the COVID-19 mandate.

Additionally, the IRS issued notices to clarify some of the more confusing facets of the ERTC. For instance, the safe-harbor rule was made clear.

A safe-harbor is a rule that allows an employer to deduct certain amounts from gross receipts. Specifically, this rule applies to ERTC, as well as the tip credit.

Exclusions from gross receipts

The IRS has released revenue procedure 2021-33, which establishes a taxpayer-friendly safe harbor rule for determining eligibility for ERC. This special safe harbor permits an employer to exclude certain items from gross receipts. It applies to wages paid before January 1, 2022, and after March 12, 2020. Specifically, the safe harbor allows an employer to exclude amounts received through coronavirus relief programs and restaurant revitalization grants from gross receipts.

In addition to the taxpayer-friendly safe harbor, the IRS has also emphasized that an employer must use the safe harbor consistently. Specifically, the safe harbor must apply to all employers treated as a single employer under the ERC aggregation rules.

An employer may qualify for an ERC based on a specified percentage decline in gross receipts. For example, an eligible business must show a 20% decrease in gross receipts for the year 2020. Additionally, an employer must show a 25% decrease in gross receipts for the first quarter of the year. If the decrease is greater than the 20% threshold, the employer may qualify for two full quarters of ERC.

As mentioned, the IRS has determined that participation in CARES Act loan forgiveness programs without a safe harbor would preclude some employers from claiming the ERC. However, the IRS believes that Congress intended to allow participation in ERTC in conjunction with CARES Act loan forgiveness programs.

Although the safe harbor only applies to ERTC gross receipts computation, it is also important to evaluate excluding PPP loan forgiveness from gross receipts. A taxpayer may exclude a forgiven PPP loan from gross income, but not from a basis increase. Moreover, a forgiven PPP loan may affect a taxpayer's ability to demonstrate a decline in gross receipts.

Claiming the ERTC

The IRS ERTC program may be the perfect way to recoup COVID-19 expenses. However, there are a few things you need to know about the program. For example, does your business qualify? And what are the steps you need to take to claim it?

A good rule of thumb is to consult a tax professional. These individuals can help you determine if your company qualifies. Having the right documentation ready can make the difference between a smooth audit and a bumpy ride.

It's also wise to do a bit of due diligence on the ERTC program before you jump into the application process. The IRS warns that third party firms are taking advantage of the program and charging exorbitant up front fees. This can lead to a less than stellar result.

The ERTC program is a refundable credit tied to payroll. Eligible businesses may apply for a credit of up to $26,000 per employee. In order to receive this amount, your business must have been impacted by government orders. If you were affected, you could save a lot of money on payroll taxes.

One important aspect of the ERTC is that it can be applied retroactively. This means that you may be able to claim a credit for any qualified wages paid between March 13, 2020 and September 30, 2021.

The ERTC can be claimed on up to 70% of your eligible wages. To maximize the benefits of the ERTC, your business should include non-payroll costs such as rent, utilities, and operations expenses in your calculations.

While the ERTC program is relatively new, the IRS has released several documents to provide guidance. Check out the IRS's website for more information.