There are several different qualifications that businesses can have to qualify for the ERTC. Some of these requirements may include having a PPP loan, having lost revenue due to the COVID-19 pandemic, and having a maximum of 100 full-time employees, but these have recently changed so check with us concerning current qualifications.

Businesses with more than 100 full-time employees

Business owners with more than 100 full-time employees may qualify for the Employee Retention Credit (ERC) qualification. This refundable tax credit provides a reduction in the aggregate salary deductions of an eligible employer. However, the ERC has specific criteria for determining eligibility. In order to qualify for the credit, a business must meet a number of requirements.

The business must have fewer than 501 W2 employees in a qualifying quarter and demonstrate a loss of 20% or more on the gross receipts test. In addition, the business must have been in operation before February 16, 2020.

A qualifying quarter is defined as the first calendar quarter of the year. Qualified wages are the wages that an eligible employer pays during a period of suspension in operations, declines in gross receipts, or business interruptions. During the first part of the calendar quarter, the business performed services and during the second part, it was forced to suspend operations.

Qualified wages must be earned by a full-time employee who works at least 30 hours per week. Unless the employee's earnings qualify for other types of employment taxes, the ERC is only applicable for wages that are paid when the employee is not providing services.

In order to qualify for the ERC, the business must submit an updated Form 941. It will take about thirty to sixty days for the IRS to process an amended return.

The business must also keep records of grant use. Any grant funds received during the eligibility period must be used for eligible uses by June 30, 2022. For example, in order to qualify for a Restaurant Revitalization Grant, the business must have used the funds by March 11, 2023.

An Eligible Employer is a corporation or other legal entity that meets the requirements of section 52(a) of the Internal Revenue Code. A qualified business must have average full-time employees in the calendar year. If the business exceeds more than 100 employees, the Eligible Employer treats any wages paid to an exempt salaried employee as qualified wages.

Businesses with more than 100 full-time employees are also eligible for the Restaurant Revitalization Fund (RRF) as long as they are operating at least one restaurant in a community. However, the RRF is not considered as qualified wages for the employer retention tax credit.

Businesses that lost revenue directly due to the COVID-19 pandemic

The coronavirus pandemic has had a massive impact on the small business sector in the United States. Many small businesses have lost revenue directly due to the COVID-19 pandemic. These businesses have also faced the other effects of the virus on business activities, including mass layoffs. Despite the large scale of the crisis, many small businesses are still operating.

Among the most notable impacts on small businesses were changes in consumer spending patterns. Many consumers reduced spending as a result of the threat of the virus. Despite the reduction in demand, many small businesses cut expenses to make up for the loss of revenue. However, some businesses did not recover their losses in April. This suggests that the timing of the economic recovery is uncertain.

The most common type of business affected by the COVID-19 pandemic was restaurants and retail stores. These businesses had the most extensive impacts on the economy. In addition, they had less severe impacts on the supply chain.

Other industries such as personal services and healthcare were comparatively less affected. However, all businesses were affected by restrictions on customer movements. Those businesses that had high levels of person-to-person contact were particularly hard hit.

Similarly, businesses that had the most substantial revenue increases were those with food and beverage stores. Furthermore, home improvement projects probably increased due to the pandemic.

Although the internet may seem like a panacea, it has also had a significant impact on small businesses. During the pandemic, many consumers switched their purchases online. Some small businesses were able to continue operating by using alternative channels, such as telecommuting.

Several small businesses have experienced a decline in cash balances. Asian-owned firms have had the most dramatic drops in revenues, with a decline of more than 60 percent. They may not be representative of all Asian-owned firms nationwide. Nevertheless, they should be considered a relevant indicator of the small business industry's resilience to adverse shocks.

For small businesses to fully recover from the COVID-19 pandemic, virus control must be implemented. In addition, small businesses should communicate with their customers and suppliers and manage their expectations. It may be prudent to take the time to reduce expenses in anticipation of a potential recovery.

Businesses that received a PPP loan

Businesses that received a PPP loan may qualify for ERC, or Employee Retention Tax Credit, depending on what type of PPP loan was used. This credit can be claimed on a company's quarterly taxes, and can be used for certain health insurance costs. However, there are certain limitations.

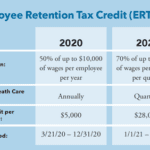

The Employee Retention Tax Credit (ERC) is a tax credit for businesses that can help offset some of the cost of maintaining their employees. The credit can apply to qualifying wages paid between March 12, 2020 and September 30, 2021. In order to qualify, an employer must document the number of qualified wages they are paying, and how much of it is subject to FICA taxes.

The IRS has put together some guidance to help you figure out if you are eligible. These guidelines are based on the PPP loans that were made available to businesses and individuals during the COVID-19 pandemic. You can learn more about the credit by visiting the IRS website.

There are also some other programs that are still in effect during the COVID-19 period, including the Shuttered Venue Operators Grant and the Restaurant Revitalization Fund. While these programs are not directly related to PPP, they are similar and offer valuable financial relief to businesses.

Another program that helps companies with small workforces recover is the Small Business Disruption Credit. If your company has experienced a major decline in gross receipts, it might qualify for this program.

Finally, the IRS has a worksheet to help you find out which of the many tax rebates you are eligible for. The PPP loan has been a boon to a number of businesses during the COVID-19 pandemic. With guidance from an expert, you can maximize your eligibility for this tax relief.

Regardless of what program you qualify for, be sure to use every tool at your disposal to mitigate any potential financial loss. From payroll tax rebates to employee retention tax credits, there are tools available to help you survive the pandemic. Use these and other resources wisely to ensure the future success of your business.

Churches eligible for the ERTC

If your church or nonprofit organization has suffered a decline in gross receipts, you may qualify for the ERC. You can claim the credit through a refund on an amended Form 941, which is a quarterly payroll tax return. There are some very specific criteria for determining eligibility. Fortunately, there are experts who can help you navigate the complicated process.

The first requirement for churches is that they have experienced a significant decline in their gross receipts. This can occur in any quarter. But it has to be at least 20%, according to the IRS.

Another requirement for eligibility is that the church must have suspended gatherings or operations because of COVID-19 mandates. This could include a vendor disruption, canceled events, and reduced hours of operation.

Finally, a church or nonprofit must pay its employees a minimum of $40K-$50K per quarter. Each employee is eligible for a maximum credit of $7K for the first two quarters of 2021, increasing to $14,000 for the entire year. However, the amount of the credit depends on the number of workers in the church in 2019.

It is important to understand that the credit is a retroactive recovery for any payments that a church or nonprofit made to the government in 2020. In order to receive the credit, the church must file an amended Form 941 for the relevant quarter.

In addition, the church may choose to compare its gross receipts for the second quarter of 2020 to the second quarter of the previous year. To determine if the church qualifies for the credit, it is best to seek advice from an expert in ERTC tax credits. A professional can save you time and ensure that you meet all the requirements.

If you believe your church is eligible for the ERC, consult with your CPA or legal advisor to verify. While it can be difficult to find the right expert to help you, it is definitely worth the effort.

If you are interested in claiming your ERTC, contact Wisdom for assistance. We have experience doing ERTC credit evaluations for US churches and can help you determine your eligibility.