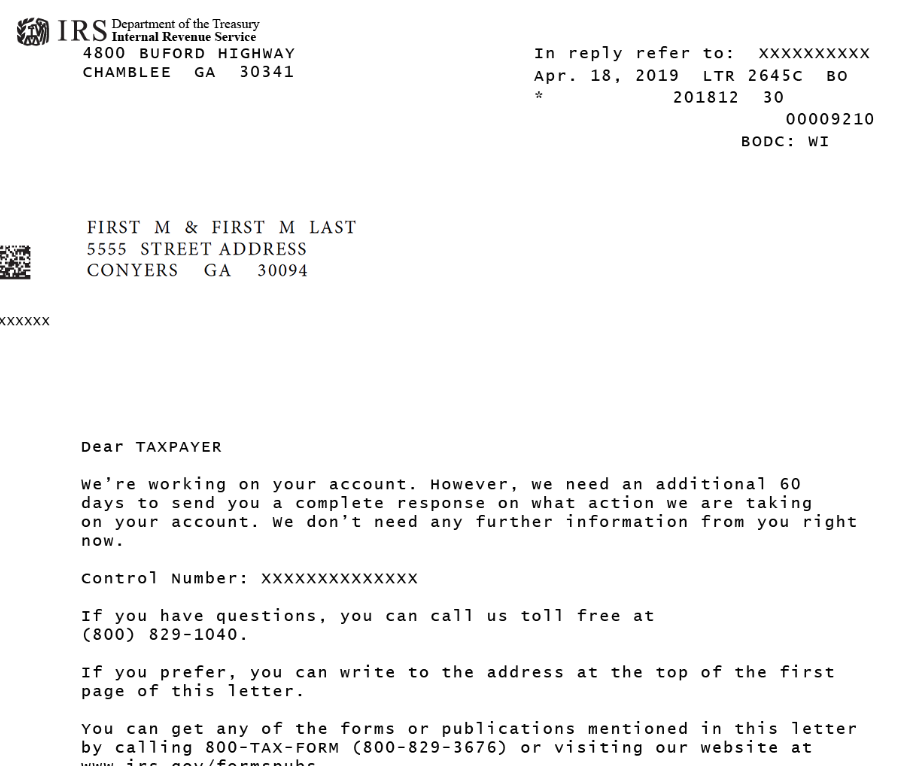

The time it takes for the IRS to process your erc refund depends on a variety of factors. Some of the factors include delays from the government, policy changes, and documenting the claim. If you're experiencing a delay, you may want to check with the IRS to see if there are any special circumstances.

Employee Retention Credit

If you are one of the many businesses that have been waiting for the Employee Retention Credit refund to arrive, you may have noticed that the process is taking longer than expected. While it is true that the IRS is not rushing to process this type of tax return, there are some steps you can take to make sure you receive your refund on time.

One way to speed up the process is to file for an expedited refund. You can contact the IRS or your local office to apply. Once you have filed your refund request, you will need to wait until it arrives in your bank account.

Another way to speed up the processing is to pay your estimated taxes. The IRS estimates that refunds for 2021 will arrive in your bank account three weeks after the IRS accepts your return.

Another option is to apply for advance payment of the credit. This is done by filing Form 7200. When you do, you will have access to the IRS refund tool, which will allow you to check your status and correct any errors on your Form 941.

In addition, you can also contact the Taxpayer Advocate Service, an independent organization within the IRS. They will work to resolve any issues you may have with the IRS and will help you get your ERC refund as soon as possible.

The IRS has been backlogged in processing millions of tax returns, including those that claim the Employee Retention Credit. These delays have resulted in some businesses waiting more than a year for their refunds to arrive.

However, the IRS is working to reduce its backlog. A few ways to speed up the ERC processing process are to make estimated tax payments, consult a CPA, and file for an expedited refund.

IRS delays

The IRS has been dealing with some unexpected tax refund delays. According to an IRS press release, they have been overwhelmed by a pile of returns. Several million taxpayers are waiting for their money.

Those who filed electronic tax returns also saw delays. They can track their refund by using Where's My Refund. This service allows you to check your status once a day. You can also call the IRS to inquire.

The IRS has made some progress on processing individual tax returns. As of June 10, 143 million returns had been processed. However, the IRS still had an inventory of 13.3 million returns waiting to be processed.

The IRS has shifted employees from other areas and added new contractor support. Some of these personnel are working on reducing the backlog.

While the IRS has improved their efficiency, the agency is still struggling with funding and staffing shortages. Despite their best efforts, it will be hard to increase their processing rate by a significant amount.

One way to help the IRS deal with its backlog is to make sure you file your taxes as soon as possible. Even if you file early, you may have to wait until later in the year to receive your money.

While the IRS has improved its overall efficiency, many taxpayers are still dealing with slow refund processing. During the past few years, millions of taxpayers have been affected by the agency's problems. There have been numerous reports of errors, including some related to identity theft. Also, the IRS has been dealing with the COVID-19 pandemic, which has caused significant disruptions.

Many of the delays are a result of missing forms or other minor math errors. While the IRS says they are updating their systems to catch these errors, the agency's statistics show that this hasn't been the case.

Government policy changes

Employee Retention Credit (ERTC) refund processing time may be down a few months from the original schedule. This may not be a major hardship for large businesses, but for small and midsize firms it can be a big deal. In fact, it could mean the difference between foreclosure and staying in business.

The IRS attributes delays to a high volume of ERTC claims and the sheer complexity of the program. However, it isn't always clear which taxpayers have the most difficulty. A recent report suggests that some businesses have had their refunds delayed by as much as nine or twelve months. Despite this, the agency says it is making progress in reducing the backlog.

Despite the agency's good intentions, the ERC has left some companies in a precarious position. These firms must now dig deeper into their reserves to make up for the delays. Adding to the problem is a significant staffing deficit.

Keeping track of your refund is crucial, as the IRS has been known to reroute returns to offices with more staff, causing delays. It also sends correspondence via snail mail rather than email, which can cause further complications.

Luckily, there are some things you can do to mitigate the effects. First, file your ERC correctly. If you haven't already, use a service like ERC Today to verify your eligibility and expedite the process. Next, file your return online, as it will speed up your payment by up to four or five weeks. Finally, you might want to consider investing in a little funding to ensure that your tax return is processed on time.

If you are interested in claiming the ERTC, there is still plenty of time to file. You have until March 2021 to file your ERC.

Documentation required to claim an erc refund

Documentation is important to a successful claim for an ERC refund. You should document how much you spent on wages paid to employees, how many wages were earned, and how much you are able to claim as a credit. This information will be required during an audit.

To be eligible for the ERC, you must submit an application to the IRS. Specifically, you must show that your business operations were partially suspended due to the COVID-19 mandate. It is also important to identify any governmental orders that imposed limitations on your operations.

After filing your claim, the IRS will send you a check for the amount you are eligible to receive. The credit will be applied to your future payroll taxes. If you are not sure if you qualify, consult a tax professional.

An experienced tax expert can help evaluate your eligibility for an ERC. However, estimating your credit is difficult and involves several restrictions. There is a 30-day limitation on calculating your credit, and your business may not be in existence in 2019.

In addition, some businesses that do not exist in the calendar year of 2019 are permitted to estimate the amount of their credit based on a comparison to the gross receipts of the same company in the calendar year of 2020. These restrictions make calculating an ERC refund extremely complicated.

For further information, contact an ERC expert at Meaden & Moore. Our agents can explain the ERC to your unique situation. We have assisted clients with over $10 million in credits. Whether you need assistance with filing an application or evaluating your existing claim, we can assist you.

Depending on your circumstances, you may be eligible for a retroactive ERC refund. The deadline for applying for a retroactive refund is April 15, 2025.

Guaranteed IRS audit protection

The Employee Retention Credit (ERC) is a tax credit designed to incentivize small businesses to keep their employees on the job. In order to qualify for the credit, you must meet a number of requirements.

While the ERC is not new, it's been incorporated into the CARES Act stimulus package, which was passed in March of 2020. If you're not able to claim it, the IRS may audit you and reject your refund.

To claim the ERC, your organization must first calculate the average number of full-time employees you expect to have on your payroll in 2019. This includes employees who work 30 hours a week or 130 hours a month. Your organization will then need to reduce the amount of money you deduct for qualified health insurance costs, and thereby qualify for the credit.

Using the right vendor to help you claim the ERC is a smart move. You may want to consider a provider with a track record of success. They may be able to provide guarantees or indemnification for any penalties or interest if your claim is found to be fraudulent.

However, if you're considering a vendor, make sure they follow the IRS's procedures, including ensuring they have all the information necessary to prepare a valid ERC claim. Some vendors will make claims on your behalf based on questionable qualifications, charge you a hefty upfront fee, and then short-change you on the actual amount of your refund.

When it comes to the best way to claim the ERC, you'll need to decide what's in it for you. Not only is there a risk of your claim being rejected, you may also have to repay a portion of the money you received.