The Erc 2023 Qualifications can help you get the job you want. You will be able to find information on requirements and salaries. There is also a date that you will need to meet. For example, if you are employed in a company that has less than 100 full-time employees, you will qualify for the wages.

Employers with 100 or fewer full-time employees

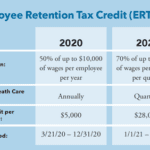

Employee Retention Credit (ERC) was introduced in March 2020 as part of the Coronavirus Aid, Relief and Economic Security Act (CARES Act). It was intended to provide temporary relief to businesses during a financial crisis and to encourage employers to keep their employees during a pandemic. Since then, it has expanded significantly and has provided billions of dollars in relief to qualifying employers.

For the 2021 tax year, the credit is now available to larger employers as well. The credit is 70 percent of the first $10,000 of qualified wages per employee paid in each qualifying quarter. Larger employers may also qualify for a proportionate amount of the costs of providing health benefits. Qualified wages include wages that are paid during periods of economic hardship or when the employer's operations are suspended or curtailed.

However, there are rules and limitations to the credit. These rules can make it hard to know whether or not your business qualifies. Fortunately, there are specialists that can help you understand the program and ensure you get the most out of it.

To determine your eligibility, you must first calculate the gross receipts of your business. You need to have fewer than 501 W2 employees in the fourth quarter of the year. If you exceed this number, you aren't eligible for the credit.

The IRS has released guidance on how to use this rule. It explains that wages paid to employees for vacations are not included in the qualified wages count. This is because the wages are not actually considered part of the gross receipts of the business.

Businesses must also prove that they lost 20 percent of their gross receipts in the fourth quarter of the year. Previously, the CARES Act allowed businesses to claim the credit if their gross receipts dropped by 10 percent or more from the fourth quarter of the previous year. In the final days of the fourth quarter, the eligibility threshold has been changed to a 20% decline in gross receipts for the same calendar quarter in 2019.

The ERC also provides protection to businesses that receive payments from Paycheck Protection Program loan recipients. Businesses that received a PPP loan can now claim a credit for their wages.

Qualified wages

The Employee Retention Credit (ERC) provides an incentive to businesses to retain employees and prevent them from going out of business. The IRS is providing guidance to assist businesses with claiming their ERTC.

In order to qualify for the ERC, businesses must pay employees in each of the first three quarters of 2021. Employers can claim a credit of up to $7000 per employee in each of these quarters. If you are a small or medium-sized business, you can also qualify for an ERTC grant of up to $26,000. However, there are many factors to consider before claiming this credit.

For most companies, the ERC is calculated using the Gross Receipts Test. This is an analysis of sales, revenues, and expenses. A qualified employee is one who works at least 130 hours per month, which equates to 30 hours per week. Moreover, wages can only be claimed for eligible employees. Depending on the size of your business, you may be able to include health care expenses in your calculation.

In addition to gross receipts, the CARES Act includes other criteria in determining whether an employer has qualified wages. Specifically, the act defines qualified wages as those paid to an employee during a period of significant decline in gross receipts.

The CARES Act was passed to help keep businesses afloat during the financial crisis. The credit is equal to 50% of qualifying wages for all employees through 2021. It is a refundable credit. Basically, the more employees you have, the more you can claim.

There are two ways to calculate the Employee Retention Credit. One is to count all qualified wages for all employees in a quarter, or use the government's definition of qualified wages. You can also use a method that uses the average number of full-time employees for a company in the current year.

While the CARES Act isn't clear on how it determines a qualified wage, the IRS's website offers guidance on the subject. They've even issued a downloadable PDF with detailed FAQs. As a rule of thumb, you must not include wages for sick days or other days off in your calculation of qualified wages.

Expiration date

The Employee Retention Tax Credit (ERTC) is a federal program that encourages employers to hire and retain employees. In return, they are entitled to a federal tax credit, up to 70 percent of qualified wages.

To claim the credit, eligible businesses must file Form 7200, the employee retention tax credit form. ERC experts are available to help businesses optimize their tax returns. One thing to keep in mind is that the ERTC is not a one size fits all program. If you have more than 100 employees, you have three years to look back on your payroll and see if you qualify for the ERTC. It is also possible to retroactively claim the credit until 2024, although this is not a requirement.

A good way to determine whether your business is eligible for the ERTC is to compare your gross receipts from the last calendar quarter to the same quarter in the previous year. For example, if your gross receipts were $1,000,000 in the third quarter of 2018, then your total gross receipts for the same quarter in the first quarter of 2019 should be around $850,000. This gives you a nice incentive to hold on to your employees!

One important implication is that if you fail to pay your payroll taxes, you could be hit with a hefty fine. That being said, if you make a good faith effort to reduce your tax deposits, the IRS will likely waive any penalties incurred. Of course, you still have to file your employment tax return and report your new deposits.

The ERC is a good example of why the Federal government has a vested interest in keeping taxpayers out of trouble. With the assistance of ERC specialists, your business can maximize its benefit while protecting you from potentially disastrous consequences. So, if you haven't taken advantage of the ERTC before, now is the time. Ensure you make the most of it by filing your form in a timely manner. Until then, if you have any questions, contact the ERC program coordinator at the NIDCD.