A refundable tax credit is a form of tax credit for which employers and self-employed people are entitled to receive refunds. There are many different types of businesses and 501(c) organizations that qualify for this type of tax credit, and the requirements vary according to the type of business that the tax credit is awarded to.

Employers

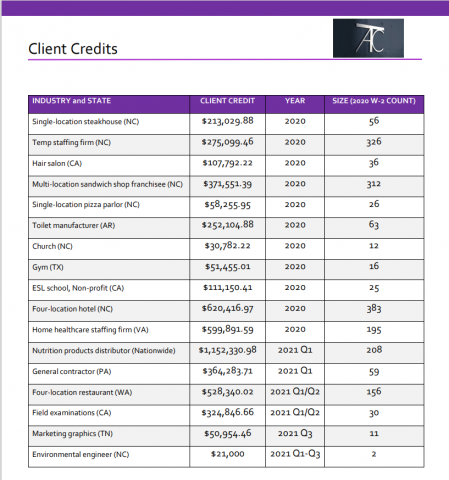

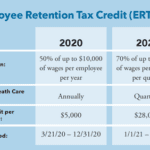

If you're not sure whether or not you're eligible for the Employee Retention Credit (ERC) there are a few things you should know. It's a refundable tax credit that's designed to help businesses with tough times. The government pays you back for any losses you incur. Depending on your business, you can receive a credit of up to $26,000.

The Employee Retention Credit is not the only incentive available to employers. You may also qualify for the Shuttered Venue Operators Grant and the Restaurant Revitalization Fund. However, these won't count as “qualified wages” for the employer retention tax credit.

In addition to being a tax credit, the ERC has a few other important features. For instance, it can be applied retroactively and it can be claimed against applicable employment taxes.

Additionally, the ERC is based on a number of different factors, such as the amount paid to employees during qualifying quarters. For instance, if your business had fewer than 50 employees during a single qualifying period, you could earn the maximum ERTC.

The best part about the ERC is that it can be used to help offset the costs of keeping your staff. This can include the cost of health insurance and other related expenses.

Self-employed freelancers

Getting a tax credit for being self employed isn't the most appealing thing to say to your employer but it is a fact of life for many a self-employed dot com. A tax break is nice and all, but the last thing you want is to be suckered into giving up all your hard earned money to the taxman. To avoid this, make sure you are on the ball when it comes to filing your taxes and claiming your deserved tax break. The IRS is a tricky business and you'll want to arm yourself with the right information to make sure you don't end up in hot water. Luckily, there are a few tips and tricks to help you snag the prize, like using the right kind of tax filing software, and knowing your tax limit so that you don't have to be surprised when you get a bill in the mail. It is also a good idea to get a professional to review your tax filing to avoid being blinded by a big check you didn't intend on.

Hospitals

If your hospital or healthcare provider is struggling with a drop in revenue, it might be time to look into the Employee Retention Tax Credit. This is a federal tax credit that encourages employers to keep employees. It is available to many medical practices, including dental clinics. However, the eligibility for ERTC will depend on the size of the organization.

ERC eligibility depends on the number of full-time employees. A practice with fifty employees could qualify for up to $1,650,000 in ERC between 2020 and 2021. Likewise, a small, single-hospital system could be eligible for the entire $7,000 in ERC for the quarter it closed in 2020.

The 2021 ERC will increase to a maximum of $28,000 per employee. Additionally, the maximum wage qualification for the ERC will increase to 70% for 2021. For this reason, it is important to understand the eligibility requirements for the credit.

To be eligible for the credit, an employer must show that gross receipts decreased at least 50% in the year. The IRS offers guidance on determining whether an employer has met these requirements.

If you suspect that you may qualify for the credit, you should work with your payroll service to gather your tax information. The information will be used to calculate the ERTC.

501(c) organizations

Employee Retention Credit (ERC) is a refundable payroll tax credit that encourages employers to keep their employees. It can be used in conjunction with the Paycheck Protection Program, a federal loan program. However, there are some restrictions.

ERC is not available to self-employed individuals or governmental employers. Moreover, it is not available to nonprofits that are not 501(c) nonprofits. Nevertheless, it has proven to be very useful in many situations.

For nonprofit organizations, the ERC may be used along with other relief options. For example, if an organization is unable to continue operations due to a government order, it can file a claim for the credit. In addition, it can be used by a food bank that transitions into delivering food.

The tax exemption does not make an organization exempt from filing special-purpose tax returns. Therefore, if an organization plans to use ERC, it must file Form 990, 990-EZ, or 990-N. Alternatively, it can file through an authorized e-file provider.

The eligibility requirements for the credit vary by size of the company. For example, a nonprofit with fewer than 50 full-time employees qualifies for the credit. But it does not apply to organizations that are primarily engaged in the provision of social welfare services.

IRS clarified that tips would be included in qualified wages if these wages were subject to FICA

The IRS has clarified that tips are included in qualified wages when they are subject to FICA. This is a significant change that is meant to encourage businesses to keep their employees on the payroll.

There are a few different reasons why the IRS has changed its position on the topic. Previously, they were unsure if tips are considered to be earnings under the CCPA. In addition, they were not sure if tips are eligible for the Employee Retention Credit.

To answer the question, the Internal Revenue Service issued a revenue procedure in August of 2021 that provides a safe harbor for employers. It also clarifies some key aspects of the ERC.

For starters, a tip is considered a qualified wage if it is over $20 in a calendar month. If your business receives this sort of income, you are likely to get a nice chunk of cash.

However, the ERC is not available for every business. You can only use it if you are one of the few that qualify. Among other things, this credit is available to firms with more than 100 full time employees.

The ERC is a tax credit designed to encourage employers to retain their employees. Employers can claim the credit for up to 70% of their qualified wages.

Refund in the form of a grant

Earned Revenue Credit is a refundable tax credit for employers. It is offered under the CARES Act. This act, part of the $2.2 trillion stimulus package, was designed to help businesses retain employees during the COVID-19 pandemic.

The CARES Act expanded the eligibility for ERTC. While originally available only to employers who closed due to the COVID-19 pandemic, the act now allows businesses to carry forward unused credits from 2020 into 2021.

Earned Revenue Credit is not based on income taxes, but rather on payroll. Businesses that qualify for the credit can receive a refund of up to $26,000 per employee.

For the full year, businesses can receive up to $28,000. Businesses may also be eligible to receive 50% of qualifying wages from the Paycheck Protection Program.

To qualify, the business must have experienced a significant decline in gross receipts. This decline must be defined by a decline of at least 20%. The IRS will calculate the amount owed to the government. ERC will not apply to wages paid in connection with SS324 grants.

ERC will not apply to payroll wages paid under the Restaurant Revitalization Fund grant or to the Shuttered Venue Operators Grant. In addition, the PPP funding may be allocated to wages that do not generate ERC.

Expiration date

The Employee Retention Tax Credit (ERC) is an incentive to help keep your employees and reduce payroll costs. It is based on the amount of qualified wages that you have paid during the qualifying period. This credit is equal to 50% of the wages paid up to $10,000 per employee.

Businesses with 500 or fewer employees are eligible to apply for the credit. Employers who have been granted grants should retain records of how the grant was used. In addition, businesses should review their financial statements to determine the amount of money that may be eligible.

Small business employers can qualify for a tax credit of up to $700 per quarter. Businesses that have suffered a significant decline in gross receipts as a result of the COVID-19 pandemic are also eligible to claim. For a business to qualify for the credit, a decline of at least 20% in gross receipts must have occurred during a single quarter.

If you are a business with more than 500 employees, you can still claim the ERC. However, you may be able to exclude certain grants. These include the Shuttered Venue Operators Grant, the Restaurant Revitalization Fund, and the SVOG.