If you are a small business in Canada, you may have heard about the ERTC. It is an excellent way to save money on your taxes. However, it comes with some new complexity as well. So, it's best to learn more about it, particularly the ERTC expiry date and how to make the most of it.

Eligibility for small businesses

If your small business needs assistance with payroll taxes, you may be eligible to claim the Employment Retention Credit (ERC). This credit helps businesses that are struggling with payroll tax obligations. However, it can be a complicated process. It is important to consult an experienced tax attorney to help you understand how to claim this credit.

To qualify for the ERC, your small business must meet specific criteria. For example, your company must have a minimum number of employees and pay qualified wages. Moreover, the ERC is calculated based on the amount of qualified wages paid to each employee. The maximum credit available is $28,000. You can also request advance payment if you are expecting to receive a refund from the IRS.

ERC eligibility depends on the calendar year and the size of your business. In addition, your employees must also meet the requirements. There are certain exceptions, such as nonprofits. Your employees must also be full-time and average at least one quarter of time with you. Depending on your payroll and non-payroll costs, you will need to include them when filing your application.

ERC is a refundable payroll tax credit. Specifically, it is a 50% credit against the employer's share of social security taxes. Businesses can take advantage of this credit through the first three quarters of 2021. However, it will expire on January 1, 2022. So, it is best to find out whether you qualify as soon as possible.

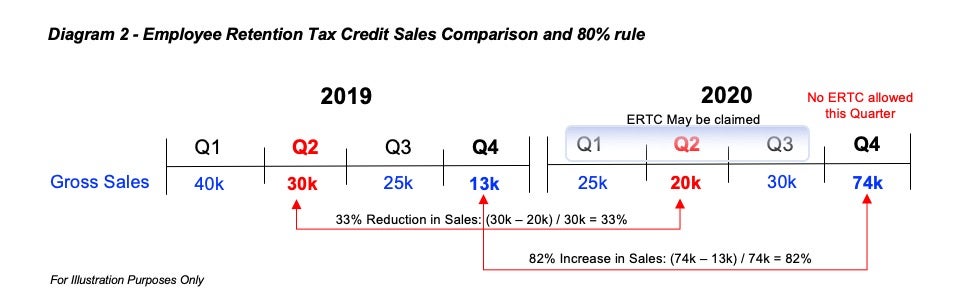

In order to be eligible, you must have a minimum of 500 employees. Also, your business must experience a significant drop in gross receipts from the prior quarter. This can be verified by comparing the same quarter's receipts to those from the quarter before or after. If your business' gross receipts have fallen 20% or more during a single quarter, you will be eligible to claim the ERTC.

In order to make a claim, your business must submit the appropriate documentation to the IRS by the quarterly deadline. However, the IRS estimates that it will take six to 10 months to receive reimbursement. After that, you must file a Form 941-X adjustment to your initial return. This is because the IRS requires businesses to include non-payroll costs on their loan forgiveness applications. A non-payroll expense includes things like rent, utilities, and other operations expenses.

If you are a startup business, you can claim a recovery startup credit of up to $50,000 per quarter. Nevertheless, you cannot claim this tax credit if you have received a Paycheck Protection Program (PPP) loan. PPP loans are forgiven, though, if they are used to pay payroll.

Although there are certain conditions that must be met in order to be eligible for the ERTC, the CARES Act and the American Rescue Plan Act extend the credit through the end of 2021. Small businesses can still claim this tax credit, and it can be a useful tool in overcoming the challenges of the current economic climate.

Refunds

Employee Retention Credit is a program that helps businesses maintain their employees. In return, the employer can claim a tax credit, or refund, against their payroll taxes. The ERC is a relatively new tax credit, introduced in March 2020, as part of the CARES Act. It is available to certain employers, and can be worth as much as $21,000 per employee in 2021.

In order to receive an ERC, your business needs to meet certain eligibility requirements. These include having fewer than 50 owners, and paying a total of 500 full-time W-2 employees. Your business also needs to have experienced a significant decline in gross receipts over a period of at least one quarter. Moreover, your business must have paid wages during the tax year.

However, claiming an ERC can be a complex process. This is because the IRS has a massive backlog of claims. Additionally, delays can occur for a number of reasons, such as staffing shortages, logistics problems, or inaccurate information submitted. Unfortunately, this has led to many businesses waiting for a long time to receive their ERTC refunds.

One of the most important aspects of claiming an ERC is making sure that you do it correctly. If you make a mistake, you could end up having to repay some or all of your credit, or face penalties. Also, keep in mind that you can only claim the ERC if you're not using PPP loan funds to pay your payroll.

To claim an ERC, you must amend your Form 941 for each quarter in which you are eligible. The IRS has warned businesses that filing a claim for a tax credit should not be rushed. Although they cannot expedite the review process, they do have a dedicated phone line to help you with your query.

Another aspect of claiming an ERC that you should keep in mind is how much of your tax credit you can use to offset your payroll taxes. As a general rule, you can claim the ERC if your payroll taxes for that tax year are less than the credit amount. While this is a useful measure, it isn't the only way to save on your taxes.

For the most part, you can expect your ERC refund in about six months. In some cases, you may have to wait nine to 12 months to receive your refund. There are several reasons for the delays, including a high volume of ERTC claims and the complexity of the system.

A quick check online can help you see if your refund is on the way, though. You can also find out about the other refunds you may be eligible for. Similarly, a visit to an IRS representative can answer your questions. Finally, you can ask for a tax accountant to provide advice on how to make your ERC claim as quickly and accurately as possible.

ERTC expiry day creates new complexity for businesses

Employee Retention Tax Credit (ERTC) was a program that incentivizes businesses to keep their employees during the COVID-19 pandemic. In a bid to boost productivity and morale, employers were offered a credit to the tune of up to 70% of their qualified payroll expenses. However, the program's lifespan is expected to come to an end soon. Fortunately, for the lucky few, a new law was passed on the House floor on November 5, 2021 that will extend the credit to the end of the year. Among other benefits, the aforementioned credit will provide small business owners with an opportunity to grow their businesses without the burden of paying employment taxes.

Although the program is not going to be around forever, it may still be the best way for small businesses to survive the economic downturn. The biggest challenge will be getting business owners to recognize the ERTC as a worthwhile investment and a valuable tool in their economic survival kit. As for how to go about taking advantage of the nifty credit, the best place to start is with a business solutions provider. For instance, Greenberg Traurig LLP can advise clients on how to best maximize their ERTC entitlement in order to secure a brighter future for their business.

One of the best ways to do this is to keep an up-to-date spreadsheet of your payroll for the past several years. This will help you to determine if your staff is eligible for the ERTC and to what degree. If they are, you can get an e-mail from a representative of the IRS explaining the intricacies of the program. To make the process less of a chore, you can even engage a local tax preparer to walk you through the entire process. Once you have the paperwork in hand, you can take the next step by applying for an ERTC checkbook.