The employee retention credit has been a major boon to businesses over the last few years, providing them with significant tax savings when they are recruiting and retaining employees. However, there are some exclusions that may affect you and your business, and it is important that you know the full extent of the credit and your eligibility to claim it.

Exclusions from the employee retention credit

Employee Retention Credit is a tax credit that offsets a significant decline in gross receipts. This credit has become very valuable to some employers. However, there are some key points to consider when claiming the credit in 2021. A timely filed payroll tax return is important for faster processing and refunds. Taking a moment to understand employee retention credit rules and benefits can help you decide whether or not this credit will be beneficial for you.

There are several exemptions from the employee retention credit. These include qualified health plan expenses and qualified family leave wages. In addition, certain business revitalization grants are excluded from gross receipts for determining eligibility for the credit. The IRS recently released guidance describing these and other important aspects of the credit. If you are unclear about the rules, you can review the IRS website to learn more.

Employers that use a third party to report their employment taxes must be aware of their obligations. They are required to make adjustments to their employment tax filings on a consistent basis. For example, they must be able to identify and avoid double benefits. The IRS also wants to see that employers are consistent when reporting the employee retention credit. To accomplish this, they must follow the same approach for reporting gross receipts.

Employee retention credit has been discussed in a number of articles on the Tax Withholding & Reporting Blog. Some of the articles have highlighted the importance of filing a timely 941. Other articles have addressed the impact of employee retention credit on other credits.

The Internal Revenue Service continues to issue guidance on employee retention credit. It issued Notice 2021-20 and Notice 2021-23 in early March of 2021. Both notices provided information to employers and clarified how the credit should be applied in the first two quarters of 2020.

Those who have questions about the employee retention credit should consult the IRS's Frequently Asked Questions. Alternatively, they can visit the CARES Act webpage for more information. Several businesses have benefited from the credit, including a manufacturing firm that averaged more than 100 full-time employees in the last year. Another employer is a church that employs an ordained minister and continues to pay his salary.

A third employer is a section 52(a) controlled group of corporations. One of these is an employer, J, that had gross receipts of $1,000,000 in the second quarter of 2020. Despite the large amount of money paid out to its employees, the employer did not receive a loan from the Paycheck Protection Program. Although the IRS would seem to deem these as gross receipts, they are not taxable income.

For the remainder of 2021, an Eligible Employer can claim the Employee Retention Credit on qualified wages paid in the year. While this may seem like an easy task, it is actually quite complex.

Eligibility requirements

Employee Retention Credit is designed to help businesses retain employees. However, it is important to remember that there are some eligibility requirements for qualifying as an employee retention credit recipient. The IRS has issued guidance for employers claiming the credit. Having a knowledgeable and competent tax planner can help you navigate the many requirements associated with claiming the credit.

For example, in order to qualify for the credit, an employer must have shut down their business for at least a period of one quarter in 2020 or 2021. They must also have reduced their gross receipts by a significant amount during that period. Alternatively, an eligible employer may be in business for the entire calendar year, but must have shut down during at least part of the calendar quarter. If an eligible employer is in business for the entire year, the business can claim the credit for up to 500 full time employees.

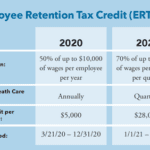

Another requirement is that the qualified wages must have been paid after March 12, 2020. Qualified wages can include wages for common law employees, as well as those that are subject to FICA taxes. Eligible wages can be up to $7500 per quarter. To be eligible, an employer must pay a total of 50% of the wages of the qualified employees in the quarter. Those wages can be used as credit for payroll taxes or can be deducted from the employer's social security taxes.

The maximum employee retention credit that can be claimed is $10,000 per quarter. This credit is available to organizations that provide health care services. Depending on the size of the company, they can claim a proportion of the qualified health plan costs. Larger employers can also claim non-service wages. Lastly, government instrumentalities and colleges can claim the maximum. Regardless of the organization's size, the total credit can be no greater than $28,000 for all of 2021.

Employee retention credit is not available to self-employed individuals or third party payers. Third party payers can deduct allocable health care expenses from their taxes, but cannot claim the credit for their own health care expenses. In addition, if the employer pays a portion of the employee's health care expenses, the employee can't be reimbursed by the employer. Finally, the employer must file Form 941-X, a quarterly federal tax return. Using a software program called ERC Today, employers can complete an eligibility questionnaire and get a comprehensive analysis of their claims.

Employee Retention Credit is a refundable credit against the social security tax. It is a form of relief that is designed to help businesses during a difficult time. While the IRS estimates that it will take 6 to 10 months for an employer to receive the credit, the credit can be applied retroactively. When an employer files Form 941-X, the credit is based on the total qualifying wages for the eligible employees. The maximum credit can be as much as $14,000 for the first two calendar quarters of 2021.

ERC expansion beyond COVID-related stressors

Despite the challenges presented by the COVID-19 pandemic, progress has been made. Although some businesses are still struggling, many are resuming operations at normal levels. The federal government has also begun to support some businesses by allowing them to claim the Employee Retention Credit. This credit can help retain employees and pay for payroll expenses. Businesses that qualify for the credit can apply to the IRS to receive a tax refund. It is available for employers that have more than 100 full-time equivalent employees. In the case of a COVID-19 business, this credit may be used to help offset the losses associated with the order.

Various ERCs have been working to improve occupational safety and health. These ERCs provide interdisciplinary training for the next generation of OSH practitioners. They also train thousands of OSH professionals each year. NIOSH supports 18 ERCs. Their outreach includes activities with workers, community organizations, local agencies, and other institutions.

One ERC, the UC OHS Research and Education Center (UC ERC), has partnered with the Cincinnati Interfaith Center for over 10 years. This relationship has helped UC ERC to connect with more than 900 partners and collaborators. For example, the UC ERC hosted Worker Memorial Day and a panel discussion about farmworker populations. As part of its outreach efforts, UC ERC has funded a survey of Chinese-speaking homecare workers.

On top of the ERC's work with the Cincinnati Interfaith Center, UC ERC has partnered with several other organizations on various initiatives. These initiatives have included a collaborative training for workers in Washington and a panel discussion about stress reduction resources for workers in Washington agriculture. Other initiatives have included the development of an anti-racism learning activity.

NIOSH is working to improve diversity and inclusion in the safety and health workforce. To do so, they have launched a new initiative, the Diversity, Equity, and Inclusion (DEI) program. This program started in June and aims to enhance workplace diversity and health equity in the occupational safety and health field.

The ERC has also made a splash on social media by using a CERKL mechanism to communicate with its hundreds of partners and collaborators. This demonstrates the University's commitment to a broader mission. While the ERC is limited in application by the CARES Act in 2020, many businesses have taken advantage of its opportunities.

In 2021, the ERC has undergone an expansion. ERCs will focus more on the health and safety of employees. They will also increase their collaborations with Asian American and Pacific Islander Serving Institutions, Hispanic-Serving Institutions, and Tribal Colleges and Universities. Aside from enhancing diversity in the safety and health workforce, the ERC will also strive to improve health and safety practices by integrating an OSH perspective into all its activities.