The IRS Retention Tax Credit is an incentive for employers to keep their employees. While it is an attractive offer, it can be difficult to know whether or not you qualify for it. This article explains the eligibility requirements and gives tips on how to apply for it.

Paying employees while shut down due to the COVID-19 pandemic

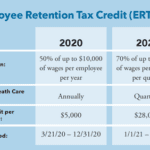

The Employee Retention Credit is a tax credit that can be claimed by eligible employers during the COVID-19 pandemic. It is a refundable tax credit that allows businesses to offset payroll taxes by a maximum of $7,000 per employee per quarter. This tax credit is designed to encourage companies to retain employees during the coronavirus outbreak. In addition to helping businesses, the credit also assists employees by giving them paid sick leave, up to ten days.

Businesses can claim the ERC by requesting advance payment on Form 7200. In addition, eligible employers can access funds through withheld taxes and federal employment taxes. However, they cannot use the ERC on wages used for other tax credits. For example, wages used to pay PPP loan forgiveness or wages used to make other qualified business expenses are not refunded.

As part of the Coronavirus Aid, Relief, and Economic Security Act, the IRS offers a refundable employment tax credit to qualifying businesses. Employers can claim the credit on all qualified wages they pay to their employees during a period of severe economic hardship. Qualified wages are generally those wages that are paid during periods of suspension, decline, or disruption in gross receipts. They cannot be higher than the equivalent wages paid during a 30-day period prior to the onset of economic hardship.

Businesses may qualify for the ERC for any quarter from March 13, 2020 through December 31, 2021. During this period, eligible employers can also receive a yearly refundable grant of $26,000 per employee. To be eligible for the ERTC, businesses must be able to prove a complete or partial shutdown due to a COVID-19-related issue. Additionally, these businesses must be able to provide paid sick leave to their employees, which is equivalent to two-thirds of an employee's regular rate of pay. Moreover, the amount of the grant can be retroactive.

The ERC is available to small and medium size businesses. The credit can be claimed for any eligible employer that has fewer than 500 employees and is impacted by the COVID-19 pandemic.

Besides being able to retain key staff during a tough time, eligible employers can also retain a portion of their social security and Medicare taxes. In addition, they can also keep their employees' share of these taxes.

In order to qualify for the credit, employees must be in quarantine or self-quarantine due to a coronavirus infection. These employees can take paid sick leave, up to ten days, to recover from the illness. Moreover, they can receive two weeks of pay if the employee is caring for a child who has the virus.

The ERC is designed for businesses that had significant decreases in gross receipts. If the business is deemed essential, it is eligible for the disaster relief credit. On the other hand, businesses that are shuttered or are severely financially distressed are not eligible.

Eligibility requirements

There are several ways to determine eligibility for the Employee Retention Credit. The IRS has issued some guidelines to assist with this process, but if you have any doubts, you should consult a qualified accountant or business solution provider. These professionals can help you navigate the program and avoid unnecessary tax penalties. You can also download a questionnaire to determine if your company is eligible for the credit.

ERC is a refundable tax credit that helps eligible businesses keep employees on their payrolls during a pandemic. It offers a refundable credit against social security tax equal to 70% of the wages paid to qualified employees. This credit can be claimed by businesses of any size. However, some businesses do not qualify for the credit. Those that qualify must apply by filing Form 941-X within three years of their initial return.

ERC can be used to offset certain employment taxes, including Social Security and Medicare. In most cases, the pre-tax amount is credited to the employee. Employers can claim the credit as a cash payment from the IRS or through a refunded payroll tax deposit. Using this credit to offset payroll taxes may be especially advantageous if your business had a significant drop in gross receipts during the COVID-19 pandemic.

The IRS has released numerous guidelines and FAQs about the ERC. They are not enforceable, however. These guides can give you a general idea of the agency's position on the issue. They include details on which companies are eligible for the credit, the most significant technical features of the program, and the benefits of taking advantage of the credit.

According to the IRS, the most effective way to calculate eligibility for the credit is to analyze the impact of the COVID-19 pandemic on your business. To do this, you need to measure your gross receipts over the past few years. When calculating the impact, be sure to account for a variety of factors, such as the number of full-time employees, the number of part-time employees, and the average number of hours worked by each.

For a new business, it is best to begin by comparing your gross receipts from the previous quarter to the current quarter. While the IRS hasn't announced specific numbers for 2019, you can use the figures from the first quarter as a reference point. If your gross receipts have dropped by more than 20 percent, you are likely eligible for the credit.

The American Rescue Plan Act and the General Appropriations Act expanded the ERC's reach, allowing more businesses to claim the credit. These two laws also eliminated some of the restrictions on the credit. A full-time employee is defined as one who works at least 130 hours a month.

The ERC is only valid for a particular quarter, but it isn't always the case. In addition to the requirements above, employers should consult a professional or their legal counsel to determine if they are eligible for the credit.

Applying for the ERTC

If you are an employer in the United States, you may be eligible to receive the IRS retention tax credit. This credit helps you to retain key employees who have faced tough times. The federal government created this program as part of the Coronavirus Aid, Relief and Economic Security Act (CARES Act) in early 2020. It is intended to encourage businesses to maintain their employees and reduce unemployment.

To be eligible for the ERC, the business must have suffered a substantial decline in gross receipts during a single quarter. For example, if you lost 20% of your business during the pandemic, you will be eligible for the ERC. You must also show that the company's business was a full-time operation during the pandemic.

The ERC can be claimed for wages that were paid before January 1, 2021. Businesses can also claim the credit retroactively. Typically, it is more than the payroll taxes they had paid in the credit-generating period. However, it can only be claimed by filing an amended Form 941X. Depending on the size of your business, you may be eligible for a credit of up to $21,000.

The IRS has published guidance for businesses interested in claiming the ERC. These guidelines provide basic information on the requirements and the process. They also warn employers against direct solicitations and advertised schemes.

The best way to find out if your business qualifies is to consult an accountant or tax consultant. They can help you determine whether or not you qualify, and can provide you with more detailed information on the various steps required. Besides analyzing your company's tax situation, an accountant can recommend specific strategies to ensure your claim is as comprehensive as possible.

There are three ways to calculate the ERC. First, you can use an estimate of how much your business can claim for each employee. Second, you can apply for a grant or award, and third, you can include non-payroll costs such as utilities, rent, and operations expenses. Non-payroll costs are not deductible on your tax return, but they are a legitimate expense that can be used to offset the amount of taxes you owe.

Lastly, if you have an existing PPP loan, you may be able to claim the ERC for a portion of the loan. However, you cannot claim the credit if you are currently repaying the loan. In the event that your loan is forgiven, you must submit an application for PPP loan forgiveness and show all of the expenses you had for eligible costs.

If you are interested in applying for the Employee Retention Tax Credit, you can visit the website of the Internal Revenue Service or a third-party provider. However, while the site might seem to be a good source of information, it is not considered to be a reliable guide to claiming the credit.