When you are determining your eligibility for the Employee Retention Credit, you need to consider whether you have retained employees through the first year of the COVID-19 (Consolidated Omnibus Budget Reconciliation Act of 2014). If you do, you may qualify for the credit.

Payroll taxes are paid for employees whose work schedules have been directly reduced but who continue to be compensated.

The Payroll taxes paid for employees whose work schedules have been directly reduced but who continue to be compensated can be a challenging aspect of paying your employees. However, there are policy measures that can help temper these fluctuations.

For instance, the San Francisco Board of Supervisors enacted new protections for hourly workers in retail chain stores. These protections require that employers give more advance notice when setting schedules. They also make it mandatory for employers to pay workers for split shifts or hours lost because of last-minute schedule changes.

Irregular work schedules are more common for low-income workers than higher-income ones. These include on-call shifts, rotating shifts, and split shifts. Some of these schedules may be mandated by law, or they are voluntarily made by the employer.

Worker earnings insecurity is a serious problem in the U.S., and it adversely affects the economy and household consumption. Income stability is further compromised by stagnant wages and limited opportunities for more hours of work. This contributes to the inability of the economy to recover from the recession.

Underemployment is especially troubling, as it complicates caregiving responsibilities and limits consumer spending. In addition, it adds to work-life conflicts by limiting employees' ability to balance their personal obligations with their work.

One way to reduce the insecurity of work is to provide more hours to employees. An additional requirement is to make part-time workers into full-time employees. There are also voluntary arrangements, and some large companies have adopted them.

A survey reveals that a nontrivial number of workers would prefer to work more hours. Blacks and Hispanics are more likely to favor more hours than whites. Similarly, women and students are more likely to want more hours than men.

Worker income insecurity has also been cited by nearly one in five Americans. Research indicates that income volatility due to irregular work schedules has adverse effects on job satisfaction, work-family conflict, and work stress.

These results suggest that policies aimed at preventing the maldistribution of work in the U.S. could benefit from an analysis of recent surveys.

Nonprofits qualify for the employee retention tax credit

Employee Retention Credit (ERC) is a refundable tax credit available to certain tax-exempt organizations. It is an incentive for nonprofits that have suspended their operations and are experiencing a decline in gross receipts. ERC is based on qualified wages paid to a full-time employee.

There are a number of ways that nonprofits can qualify for the ERC. A qualified nonprofit accountant can assist in determining if the organization qualifies. If so, the organization will need to file an amended payroll tax return with the IRS. This process is fairly straightforward. Once the organization has done so, it will receive a refund check from the IRS.

The employee retention tax credit is designed to defray some of the costs that nonprofits might incur to retain employees during the Covid-19 pandemic. Nonprofits that qualify can save significant amounts of payroll taxes. However, it is important to make sure that they are accounting for their credit properly.

ERC is a federal credit that can be taken against payroll taxes. Previously, it was only available to for-profit businesses. Fortunately, it has recently been extended. Depending on the size of the organization, a tax-exempt business could get up to $700 per quarter.

The amount of the credit is based on the number of full-time employees. For example, if a nonprofit has 500 full-time employees, it will be eligible for a credit of up to $5,000. Alternatively, if the organization has fewer than 500 full-time employees, it may still be eligible for a credit of up to $14,000.

For the 2021 ERC, it is important to know the qualification threshold. To be eligible, an organization must have a gross receipts reduction of at least 20%. In addition, a full-time employee must be working at least thirty hours a week. Part-time employees that work less than thirty hours a week are not counted.

The Employee Retention Tax Credit (ERTC) was first introduced in March 2020 as part of the CARES Act. It was originally intended for tax-exempt nonprofit organizations. However, it has since been extended by Congress and has become available to businesses as well.

Eligibility for companies in disaster zones

The employee retention credit is one of many tax incentives for businesses that suffer from hurricanes, tornadoes or floods. As a result, these companies may qualify for a 40 percent tax credit on qualified earnings. To claim it, your business must be located in a qualified disaster zone and the business must be open and operating after the aforementioned calamity. In addition, the credit must be claimed on the appropriate tax form. If you have any questions about the program, feel free to get in touch with a professional. You might be pleasantly surprised at the number of benefits that you can receive.

Aside from the aforementioned tax credit, your business might also qualify for some tax breaks in the form of a loan from the government. For instance, if your business needs a quick fix for a downed tree, you can apply for a Paycheck Protection Program loan to cover the expense. That is a small price to pay for the peace of mind that comes with having the funds on hand in the event of a disaster. Having said that, you'll need to do your homework to ensure that you're getting the most out of your tax dollars.

If you're in the market for a new loan, you may be able to snag some perks such as the employee retention credit. If your business has suffered any level of damage from a hurricane, you should take advantage of these programs as soon as possible. Fortunately, there are a variety of companies that can help you find the right financing solution for you. Taking the time to determine if your business is eligible for these tax credits will save you time and money. Moreover, these professionals can also provide a wealth of useful information that can help you decide which loan is best for your company. Depending on your individual circumstances, you may be able to receive the Employee Retention Credit in a matter of days.

Eligibility after COVID-19

If you've recently experienced a significant decline in gross receipts, you may be eligible for the COVID-19 Employee Retention Credit. This tax credit can save your business thousands of dollars. It was introduced to encourage businesses to keep their workers during the pandemic of COVID-19.

However, the legislation changed in March 2021, and there are now certain limitations. The COVID-19 Employee Retention Credit is available to qualifying employers only. A business that has lost 50% or more of its gross receipts in the last five years may be eligible.

The IRS provides a tool to help eligible employers determine their eligibility. There are a number of options for calculating the amount of the ERC. In addition to wages paid to employees, employers can also include their health plan costs as qualified wages.

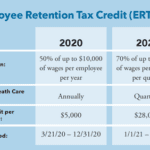

To calculate the ERC, employers must include their total qualified wages on their employment tax return. The maximum credit is 70% of the qualified wages. For example, if a company pays $1,000 per employee, the credit could be up to $21,000 for the year.

The maximum qualified wages for each employee is $10,000 in all calendar quarters. However, the credit for wages paid to any one employee in a quarter cannot exceed $5,000. These limits apply to both full-time and part-time employees.

As of September 30, 2021, the Employee Retention Credit will no longer be available. However, eligible businesses still have time to claim the credit. They can do so by requesting an advance payment of the remaining credit. Alternatively, they can make an adjustment to their employment tax returns for the 2020 and 2021 calendar years.

Businesses that suspend operations or lay off more than a nominal portion of their workforce in an economic downturn may be eligible for the Employee Retention Tax Credit. Depending on the circumstances, this credit can be worth hundreds of thousands of dollars.

While this program is intended to provide relief for businesses, the Employee Retention Credit has also been extended to tribal entities. Additionally, religious organizations that have significant declines in their gross receipts may be eligible.