The Employee Retention Tax Credit, or ERTC, is a tax credit offered to employers that retain qualified employees. Businesses with less than 500 employees are eligible to receive the credit. Moreover, non-profit organizations are also allowed to apply.

Employee retention tax credit (ERTC) eligibility

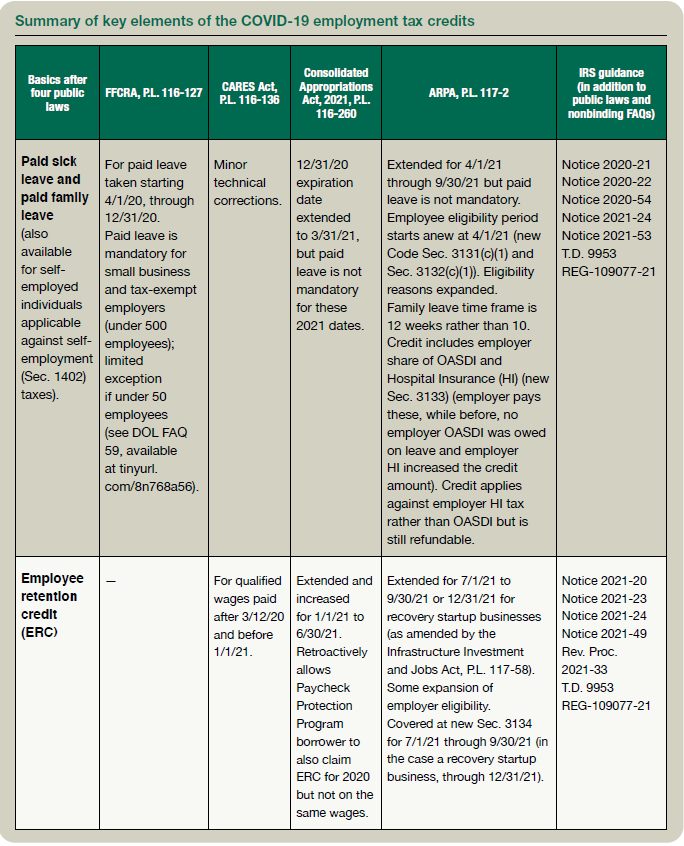

Employee retention tax credit (ERTC) is a payroll tax credit that can offset the employer's Railroad Retirement Act tax, Social Security tax, and applicable taxes under Section 3111(a). The CARES Act developed ERTC to help businesses keep employees on the payroll. Initially, ERTC was available to only eligible businesses. However, the American Rescue Plan (ARP) expanded the program to include recovery startup businesses and severely distressed employers.

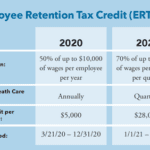

ERTC eligibility in 2021 is based on average full-time wages of 500 or fewer employees. Small to mid-size businesses can receive 50% of qualifying wages from March 13, 2020 to December 31, 2020. These businesses can keep the rest of their payroll taxes as a credit advancement.

Enhanced ERTC is also available to employers who received PPP loans. Advance payments are based on 70% of an employer's average quarterly payroll for the same quarter in the year before the advance was made. If an employer has a difference between the actual ERTC computation and the credit advanced, the employer must repay the difference.

For the first and second quarters of 2021, the IRS issued Notice 2021-23, which contains ERTC guidance. In addition to changes in definitions, this notice includes clarifications on documentation requirements and interaction with other deferrals. Among other modifications, ERTC can be computed retroactively.

Employers who expect to receive ERTC credits for the fourth quarter of 2021 must submit Form 941 by the due date of the fourth quarter. If an employer fails to deposit a payroll tax, the IRS will levy a 10% penalty on the amount of the tax owed.

As part of its ongoing review of the ERTC program, the IRS issued clarifications and other updates. Some of the more significant issues addressed in these updated notices included clarifications on the definition of qualified wages, the calculation of a credit, and the interaction between other deferrals.

Several businesses had expected to take advantage of the ERC before it was repealed by the IIJA. However, some business owners did not know they were eligible. Because of this, some businesses received reduced tax deposits. Others took out PPP loans, but could not claim PPP forgiveness on payroll costs.

Eligibility for businesses with less than 500 employees

If you run a small business, you may be eligible to receive the Employee Retention Tax Credit (ERTC). While the credit was originally scheduled to end on October 1, 2021, it was extended twice, first by the Coronavirus Aid, Relief, and Economic Security Act of 2020 (CARES) and again by the bipartisan Infrastructure Investment and Jobs Act of November 15, 2021.

ERTC is a tax credit that reduces the amount of Social Security and Medicare taxes an employer withholds from its employees. It can be secured by filing an amended Form 941-X, and the credit is computed retroactively. An eligible employer is allowed to claim a maximum credit of $7,000 per quarter. ERTC is also refundable. The credit can be used for social security and Medicare taxes, as well as federal income tax withheld from employees.

For the first three quarters of 2021, an eligible company can claim a credit of $21,000. This is equal to 70 percent of the qualified wages of its employees. Those eligible for the credit can also retain federal income tax withheld from their employees, as well as an employer's share of social security and Medicare taxes.

A new business can use gross receipts from its first quarter to determine eligibility. If gross receipts were reduced by at least 20 percent during that time, the business can request a tax credit of $7,000 per employee for the first three quarters of 2021.

To be eligible, a business must be in a controlled group, which includes the parent and subsidiaries of the business. The business can also be a member of an aggregated group that receives a Paycheck Protection Program (PPP) loan.

However, a “controlled group” does not mean that all members of the controlled group are eligible. Generally, the credit is not available to employers with fewer than 500 employees.

In order to determine whether an employer is eligible for the ERTC, a company should speak to its accountant or payroll preparer. They will be able to help determine the credit value and how much of the credit to use. Taking advantage of this program can provide a tax break for businesses that have been struggling.

Eligibility for non-profits

If you work for a nonprofit, you may be wondering if you qualify for the Employee Retention Tax Credit. The ERTC is a refundable tax credit. This credit can help offset the payroll taxes that are owed. However, you must meet certain qualifications to qualify for the ERTC.

While the ERTC can be an excellent incentive for many nonprofits, it can also be an extremely complex process. That's why it's a good idea to work with a seasoned expert. They can ensure that you file the right paperwork and that you claim the corresponding tax credits.

ERC is available to nonprofit organizations for the calendar year of 2021. During this time, organizations can claim up to 70 percent of up to $10,000 in wages. A qualified nonprofit accountant can help determine if your organization qualifies.

To qualify for the ERTC, your organization needs to have a taxable gross receipts level of less than $1 million for 2020 and 2021. Your nonprofit should also have fewer than 500 full-time employees. Adding part-time employees is not considered.

Nonprofits should perform a detailed assessment to determine whether they qualify for the ERC. Some organizations interpret the program's eligibility requirements incorrectly, which means they may be eligible for a larger refund than they actually deserve.

The ERTC program has experienced a lot of changes. Its duration was extended through the American Rescue Plan Act in March of 2021. In addition, the Families First Coronavirus Relief Act expanded its scope. These laws increased the threshold for qualifying claims, added more information about how to apply, and changed some responsibilities.

The IRS has several FAQs on how to qualify for the ERC. Although it may be tempting to claim the entire amount, it is advisable to only apply for the maximum amounts allowed.

As a nonprofit, you should make sure that you are prepared for audits. Your business can be subject to fines or have to repay the amounts you receive if you don't comply with the conditions of the ERTC program. You should start discussions with your auditor early in the audit process.

PPP and ERTC cannot be calculated simultaneously

If you received a PPP loan, you may have heard about the Employee Retention Tax Credit (ERTC). The credit can provide tax-free cash to eligible companies that had taken a loan from the Paycheck Protection Program. However, you should take a close look at how the credit works before claiming it.

The IRS issued new guidance on how to claim the ERTC. These changes make it easier for businesses to take advantage of the credit.

For example, companies that use the program can claim a credit of up to 70% of their first $10,000 in qualified wages in each quarter. To determine how much credit is available to your business, you should calculate your gross receipts. This is a safe-harbor calculation that allows you to exclude the Shuttered Venue Operator Grant and Restaurant Revitalization Grants.

There are other changes to the ERTC program, including a longer time frame for making claims. This means that more employers will be able to claim the credit in 2021.

Similarly, you may be able to take a refundable ERTC against your share of Social Security taxes. You can claim up to $10,000 per employee annually. The credit can be applied to a number of eligible expenses, including health insurance costs and some supplier costs.

Using this credit can help you reduce your tax burden, especially if you are struggling. Asure can help you figure out how to maximize your ERTC. They offer webinars and other resources to help you understand how to qualify.

Businesses should also be prepared to pay penalties for failing to follow the rules. These can range from $50 to $1,000. So be sure to contact your accountant or financial advisor to see how the credit can work for you.

Using a combination of strategies, including PPP forgiveness, can help you get the most out of the ERTC. You will need to document everything, though. Experts recommend having a detailed analysis of your payroll and non-payroll expenses, particularly for smaller businesses. Also, be sure to include only the minimum costs on your application.

If you are considering taking out a loan from the PPP, you will need to talk to a professional before deciding.