Calculating employee retention credit is something that you will want to think about as you are running your business. There are many different things that you need to look at in order to make sure that you are doing everything that you can to keep employees coming back. From the wages you pay to the health insurance plans that you offer, there are some things that you will want to remember.

Qualified wages

The Earned Revenue Credit (ERTC) is a tax credit available to employers. The credit is designed to encourage employers to keep essential workers on their payroll. It is calculated on a calendar quarter basis and depends on the size of the employer's work force. ERTC can be claimed for up to $10,000 in qualified wages for each eligible employee per year.

The IRS has created a tool to help employers understand how to calculate the ERC. To qualify for the ERC, an employer must meet two main criteria. Using the tool will ensure that an employer is able to claim the right amount of credit.

The most important factor in determining whether an employee is eligible for the ERC is the number of full-time employees that the employer has. An eligible employee is a full-time employee that works at least 30 hours per week, or 130 hours per month. However, a smaller number of part-time employees may be included in the calculation.

While the ERC does not require an employer to pay the employee a dollar, a small business may still request an advance payment to offset payroll tax deposits. This type of credit is available only to eligible employers with fewer than 500 full-time employees.

The ERC is also available to severely financially distressed employers. These are defined as those with gross receipts that are less than 10 percent of comparable quarters in either 2019 or 2020. In other words, these employers have had a significant decline in gross receipts during a particular calendar quarter.

Although there are many ways to calculate the ERC, the most basic method is to take a look at the total qualified wages that your company paid its employees in the past year. If you have questions about your eligibility for this credit, speak with a qualified tax professional. A tax professional can help you to determine the best way to claim your ERC.

Another important point to remember is that there is no one-size-fits-all rule for calculating the ERC. As with other forms of tax credits, claiming it will vary depending on your specific circumstances.

Health plan expenses

If you're an employer, you may be eligible for a tax credit for your health plan expenses under the CARES Act. This tax credit is available to employers who offer a group health plan (GHP) and employees who take FFCRA leave, such as unpaid or furloughed leave.

In order to be able to claim the ERC, an employer must have an average annual expense per employee that meets the required criteria. This number is calculated by multiplying the total cost of health plan coverage by the average number of work days for all employees covered by the plan.

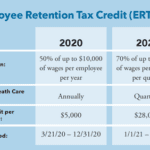

Employees who are eligible for the credit can be paid a maximum of $7000 per quarter. The credit amount for an employer with 100 or more employees is 50% of the qualified wages. For an employer with less than 100 employees, the credit is 70% of the qualified wages.

The amount of the credit depends on the type of health plan. Qualifying health plan expenses include pre-tax contributions to health flexible spending accounts and Section 125 plans, as well as health insurance premiums. It does not include after-tax contributions to health savings accounts and IRAs.

There are several ways to calculate the ERC. You can use the method outlined in the IRS FAQs on the Employee Retention Credit. Or you can estimate the credit by entering information about your business into a web form. Once you enter your data, you'll receive a free estimate of your potential credit.

Another way to calculate the credit is to use the Daily Average Cost of Maintaining a GHP. It is the same method used for the FFCRA tax credit. However, it differs for self-insured GHPs.

The IRS has clarified the Employee Retention Credit for businesses with reduced schedule employees. Some government employers are not eligible for the credit.

A business may also qualify for the credit if it's experiencing a significant decline in business. Those who are not working, but have an insured GHP, can claim the credit for up to 50% of their healthcare expenses.

Severance payments

Employee retention credit can be claimed by eligible employers on a quarterly basis. If you're not sure if your company qualifies, a consultant can help. You can claim up to $5,000 in 2020 and $33,000 in 2021. Interestingly, you can even take credit for wages paid to all employees during a forced shutdown. However, be careful, as you may be stymied by the IRS's rules.

The IRS's new form 941 has been designed to accommodate these credits. For example, you no longer need to wait until the end of the quarter to file your tax returns. In the meantime, you can claim your credit for the first time on your own payroll tax returns. To get the most out of this program, you should keep good records. These include, but are not limited to, employee attendance records, wage and hour reports, and employee benefits and compensation data. Also, be aware that the credit is refundable. Fortunately, the IRS has created a stipulation that will prevent any double dipping.

You should also note that this particular tax credit isn't just for large businesses. Smaller companies can claim up to $50,000 per quarter, thanks to the American Rescue Plan Act. As such, it's important to find out if you qualify. A good rule of thumb is to make a list of your employees, and cross-check the information with your quarterly forms. After that, be sure to take advantage of the credit before it's too late.

Another thing to consider is the IRS's Paycheck Protection Program. If your company is a small business, you should be aware that it will help you offset the expense of a tax refund in the event you have to sever a contract. This includes, but is not limited to, a 401(k) matching contribution and unemployment insurance benefits. If you are not certain about your eligibility, consult with a certified financial planner.

While it's not necessarily the most efficient way to calculate your employee retention credit, the ERC is a valuable tax break to consider. Its worth taking the time to read up on the program's requirements, so you can claim the credit on your own Form 941.

Eligibility

If your business has lost a large part of its revenue because of a pandemic outbreak or a government decree, then you may be eligible for the Employee Retention Credit (ERC). ERC can provide some financial relief to businesses, as well as help ensure that they do not lose employees and go bankrupt.

The first time you apply for ERC, you must calculate how much credit you are eligible to receive. This is based on your company's gross receipts during the calendar quarter. In some cases, your revenue could have fallen as low as 20%, but the decline must be sustainable for you to qualify for the tax break.

To be eligible for the Employee Retention Credit, your business must be a small or mid-sized firm with fewer than 500 full-time employees. You also need to have sustained a significant drop in your gross receipts during the year.

If you qualify, you can claim up to $10,000 per employee. Your credit amount will not be included in your gross income for federal and state income tax purposes. However, it will be fully refundable.

As with most other IRS tax breaks, eligibility rules are slightly different for 2020 and 2021. You should pay special attention to the information on line 18 of Form 941-X for business share.

There are other conditions that you must meet in addition to the above. For example, you must have a history of operating your business under the same trade name. Even if you have a subsidiary or parent, you cannot qualify if the business has a different name.

Despite the additional requirements, your organization may still qualify for substantial ERC benefits. Your business can recover up to $26,000 per employee.

In order to receive the ERC, you must fill out Form 941-X. Once you have the information, you can make an advance payment with Form 7200. Alternatively, you can sign out a Small Business Loan.

To avoid paying payroll taxes on your employee's wages, you must submit your ERC estimate to the IRS within thirty days of the end of a pay period. A resulting tax credit can be applied to your payroll taxes.