The Employee Retention Tax Credit (ERTC) is a tax credit that subsidizes the cost of recruiting and hiring new employees. It is available to private-sector employers. This tax credit is capped at $10,000 per employee and it is not included in the gross income of the employer. In addition, the amount of the ERTC is refundable.

It's a refundable tax credit

The Employee Retention Tax Credit (ERTC) was designed to help businesses survive during tough times. It offers a refundable tax credit to employers who pay their employees wages during certain periods. A business that pays a minimum of $10,000 in payroll taxes can claim up to $50,000 in the form of a refundable ERC refund.

ERTC offers qualifying employers a way to offset their payroll and health care costs for up to three years after the date they file their return. Businesses can claim up to $26,000 per employee. These credits are based on the amount of wages paid to each employee during the corresponding quarter.

In order to qualify for ERTC, you must have suffered a significant reduction in gross receipts for at least one of the quarters in 2020. This is due to the COVID-19 pandemic that affected the workplace.

In addition to the ERTC, the Families First Coronavirus Relief Act (FFCRA) allows qualified employers to take advantage of similar tax credits. However, FFCRA does not allow these credit amounts to be applied to salaries.

ERTC is available to eligible small businesses with fewer than 500 employees. These companies can claim up to 70% of the first $10,000 in wages per quarter for each of their employees. ERTC can also be claimed against excess payroll expenses.

While there are many benefits to ERTC, there are several steps you must follow to make sure you are eligible. If you are unsure of your eligibility, visit the ERTC Today application to get the information you need. You can then apply to receive your credit.

Currently, the IRS is backlogged with many tax returns, so you should expect a processing time of around 16 weeks. However, there is a plan in place to allow advance payments on credit, which will alleviate some liquidity issues for businesses.

ERTC is a complex tax credit, and it can be difficult to understand. Make sure you read all of the information provided in the ERTC tax credit guide before you start the process. Not doing so could lead to the taxpayer having to repay the credit and/or penalties.

It's available to private-sector employers

ERTC is a tax credit available to private-sector employers, as well as tax-exempt organizations. The program was designed as a short-term incentive to help businesses keep employees on payroll during a coronavirus outbreak. A total of 70 percent of qualified wages can be claimed by eligible employers. It is capped at $10,000 per quarter and is refundable. Currently, eligible businesses can file for the credit through 2022.

To qualify for the credit, an employer must have been affected by a government order related to COVID-19, such as an interruption of operations. Businesses must also have experienced a substantial decline in gross receipts during a particular quarter.

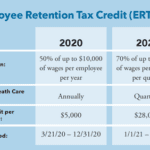

Small and mid-size employers are eligible for 50 percent of qualifying wages from March 13, 2020, through December 31, 2020. If a business pays $100,000 in payroll, it can apply for the credit as a business expense. Employers who received a Paycheck Protection Program loan can claim the credit retroactively for any past quarters.

Large employers can't claim ERTC on wages paid during 2020 or 2021. However, they can still receive advance payment of the tax credit. Depending on the size of the company, the credit may be worth as much as $700 per quarter.

For small-to-mid-size businesses, the credit can be up to 70% of the employee wages, including health insurance costs. Excess payroll expenses are also taken into consideration. Expenses include utilities, rent, and operations. In addition, Restaurant Revitalization Fund grants are excluded from the calculation of gross receipts.

The credit is not available for tips under $20 in a calendar month. Also, wages paid after March 12, 2020, are not part of the calculation of gross receipts. Fortunately, the IRS has released Revenue Procedure 2021-33, which provides a safe harbor for calculating the amount of gross receipts. This procedure excludes Shuttered Venue Operator Grants and PPP loan forgiveness from the calculation of gross receipts.

Whether or not you are eligible for ERTC depends on several factors, such as your employer status and the extent to which your business suffered a decline in gross receipts due to the government order. Using ERTC Decision Helper, a visual guide to determining eligibility, can assist you.

It's capped at $10,000 per employee

Employee Retention Tax Credit (ERTC) is a refundable tax credit that is designed to encourage businesses to keep their employees on the payroll. The amount of credit varies depending on the number of qualified employees, wages paid, and other personnel costs. However, the maximum credit is $10,000 per employee.

ERTC is offered to any business. In addition to claiming the credit, a company can also use the credit against health insurance expenses. It is also eligible for a Paycheck Protection Program loan.

ERTC was created to help businesses in the aftermath of the COVID-19 pandemic. A large number of employers were affected and were severely financially distressed. Because of this, the government decided to create a tax credit that could help businesses recover from the impact.

Businesses can qualify for ERTC if they are small to mid-size or have less than 500 full-time employees. They must also be able to show that their gross receipts have been lower than the prior year. If a business can prove that they lost money during the pandemic, then they can claim the ERTC.

ERTC can help a business to reduce its aggregate salary deductions by up to 70 percent of the total qualified wages it pays. This can help an employer offset the cost of health insurance, some perks, and other expenses.

Employers can claim up to $700 of the ERTC for each quarter in the first three months of the tax year. There is no cap on the amount of ERTC that can be claimed in the fourth quarter of the tax year.

ERTC is a refundable tax credit that is available to qualifying small to medium-size businesses. Eligible businesses can claim up to 50% of their qualifying wages for the entire period from March 13, 2020, to December 31, 2020.

To qualify for the ERTC, a business must have fewer than 500 full-time or part-time employees. Those who are part-time must be converted to full-time employees. Qualifying small to medium-size businesses can also apply for the Paycheck Protection Program.

ERTC is a valuable tax credit that can benefit any business. However, it is important to know the requirements and eligibility before you decide to claim the ERTC.

It's not included in gross income

The Employee Retention Credit (ERTC) program is available to businesses that have qualified wages. ERC is a refundable tax credit that reduces employer payroll costs. Businesses can receive up to $21,000 for the whole year and $5,500 per quarter. ERTC can also be claimed in retroactive years. In order to qualify for ERTC, your business must be affected by certain types of business disruption.

You must be a qualifying business that has incurred a 20% decline in gross receipts during the first three months of the quarter to claim ERTC. If your business is not affected by these events, you can still claim the ERTC for any pay period that was paid during the quarter.

Despite the changes to ERTC, eligible businesses are still able to claim a payroll tax credit for health insurance and health care benefits. These reimbursements will need to be reduced by qualified health plan expenses. However, these are not included in gross income for federal tax purposes.

The IRS has issued guidance on how to claim the ERTC, clarifying unanswered questions. It also provided clarifications on how to interact with other deferrals. This includes a new visual guide to determining eligibility.

A taxpayer can claim the ERTC if they are a for-profit or a tax-exempt organization. If you are a for-profit, the credit will be limited to 50% of the wages you pay. Similarly, a tax-exempt organization can claim up to 70% of the wages they pay. There are no restrictions on the number of employees claiming the ERTC.

Employers can request an advance of the ERTC from the IRS. However, the advance payment must not exceed 70 percent of the average quarterly wages they pay during the calendar year. Moreover, the amount must be repaid by the due date of Form 941 for Q4 2021.

Taxpayers who received PPP loans in 2020 satisfied all the requirements for claiming the ERTC in 2020. But, it is likely that they will experience expense disallowance in 2020. That is because the ERTC is not included in their gross income.