The Employee Retention Credit (ERC) was established to provide a tax credit to those who have contributed to the creation of new jobs by increasing employment. This is a program that has been in effect since it was enacted in the early stages of the COVID-19 pandemic. In this article, we will look at the changes in the ERC since it was introduced, as well as how it will be affected by the new Infrastructure Act.

Qualifying earnings

Employee Retention Credit is a benefit to businesses that encourages them to retain their employees. This is especially important during tough economic times. It can help your company recover from financial losses. If you are a small business or a large corporation, you may be eligible to take advantage of this tax credit.

The IRS has issued some helpful guidance on the subject. You can learn more about the Employee Retention Credit and the most important details on its website. In addition, the IRS has issued a series of FAQs to help businesses understand its requirements. These FAQs do not have any legal force.

To qualify for the Employee Retention Credit, you need to show that you have a substantial loss of gross receipts during one or more of the previous quarters. However, you can claim the credit for any of the four quarters before the fourth quarter.

The IRS has also clarified the employee retention credit's eligibility. For instance, a reduced schedule employee's hours can be used in the calculation. Also, employers can claim partial credit for part-time employees, as long as the wages they pay to them exceed the part-time wage limit.

There are many ways to calculate the employee retention credit. One method is to calculate the maximum ERC possible. This is determined based on the size of the employer, the number of full-time and part-time employees, and the total qualifying wages paid to each. Generally, the credit includes the employer's pretax contribution.

Taking the Employee Retention Credit is the best way to ensure that your employees are staying put. Depending on your business, you may even be able to take advantage of the credit for both 2020 and 2021.

Employer credits

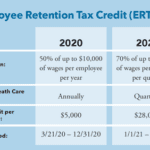

The Employee Retention Credit is a tax credit designed to encourage employers to keep workers on payroll. It is based on wages paid to eligible employees. Generally, the pretax portion of the credit is equal to 50% of qualified wages.

ERC can be claimed by businesses of all sizes. However, it is important to check if your business qualifies. Larger businesses can also claim for qualified health costs. In order to determine whether or not your business qualifies for the Employee Retention Credit, visit the IRS website. There, you can fill out Form 941-X and answer a few questions.

ERC offers employers a refundable quarterly tax credit. This is a great benefit to both businesses and employees. You can claim the credit on your federal employment tax return.

To qualify, you must meet the following requirements. First, you must have at least 50 full-time employees. Second, you must have been operating your business at least a year and a half. Third, you must have experienced a significant decrease in gross receipts. Fourth, you must have filed your taxes for at least two of the previous three years.

You can file for the employee retention credit on your Form 941-X, which is part of your quarterly federal tax return. The credit can be claimed up to $7,000 per quarter.

Employers may claim the credit retroactively by filing amended payroll tax returns for tax years 2020 and 2021. They must file within three years of the original due date. If they receive a loan from the government under the PPP program, they can use the loan to claim the ERC.

The employee retention credit was created in the CARES Act. The credit is worth up to $5,000 per employee in 2020 and up to $21,000 in 2021.

Grants

The Workforce Training Fund Program (WTF) offers grants to train current employees of qualifying Massachusetts businesses. Since the start of the Baker-Polito administration, WTF has awarded over $146 million in training grants to over 4,200 businesses.

Businesses that qualify for the grant are able to receive a grant that covers up to 40% of their payroll for two months. During this time, the business is required to provide one-time payments to their employees. This helps companies improve productivity and competitiveness.

The Commonwealth Corporation (CC) awards these grants to consortia of businesses. These organizations can apply for educational or leadership training programs. CC also awards grants to train new employees.

Another stimulus program created by the CARES Act is the Employee Retention Tax Credit (ERTC). ERTC is a tax credit for eligible employers to offset the payroll tax liabilities of their employees. ERTC is available to small and medium-size businesses. It is a program designed to help small businesses survive tough times.

Currently, the maximum amount of the ERTC grant is $26,000. However, the ERTC can be extended to small businesses by the American Rescue Plan. Eligible employers can be reimbursed for 50% of their qualifying wages up to $26,000.

During the COVID-19 pandemic, grants for employee retention were created to help businesses keep their employees on their payroll. DCYF distributed $13 million to over 3,600 licensed providers. But DCYF also ensured that there were no duplicate payments made.

The Workforce Training Fund program helps businesses improve their competitiveness and increase productivity. In addition to the grant, these programs offer a number of other resources to help businesses thrive.

Whether you are starting a new business or just retooling your existing one, the Capital One Business Grant is a great option. If you want to get your company off the ground, the program will award you $2,500 to help you start your business.

Changes to the ERC since it was enacted in the early stages of the COVID-19 pandemic

Employee Retention Credit (ERC) is an incentive that provides funding to employers to help them recover from the COVID-19 pandemic. The credit is issued to qualified employers on a percentage of qualified wages paid to their employees. A large part of the credit is refundable, allowing companies that lost revenue during the pandemic to get funding back.

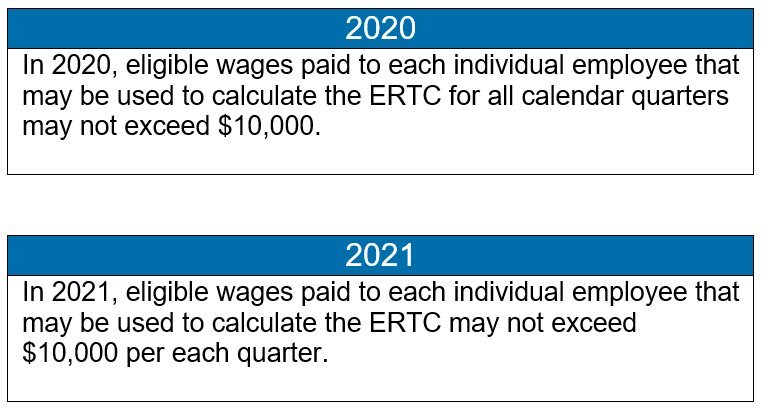

During the first few months of the COVID-19 pandemic, the ERC was created as a refundable tax credit to encourage employers to keep their workforces intact. Originally, the amount of the credit was $10,000 per employee for the entire year. This limit was raised to $7,000 per quarter.

ERC was created under the Coronavirus Aid, Relief, and Economic Security Act, or CARES. However, it was not rolled out to the entire population until the American Rescue Plan Act was passed. Since then, there have been several changes. These changes have increased the value of the credit and expanded its reach.

The CARES Act expanded ERC eligibility to a wider range of employers. For example, recovery startup businesses that had average annual gross receipts of less than $1 million could receive the full credit through December 2021. Another important change made by the CAA was the elimination of the qualifying cap on wages. Previously, the maximum wages a business was eligible to claim were $5,000 per employee for the year.

In addition, the threshold for claiming the ERC was expanded from 100 employees to 500. Additionally, employers who paid their employees through the Paycheck Protection Program were no longer excluded from the program. Those who financed their businesses through PPP loans would not be able to claim the credit.

Impact of the Infrastructure Act on the ERC

A major tax provision in the Infrastructure Investment and Jobs Act (IIJA) changed the eligibility date of the Employee Retention Credit (ERC) in 2020. This change could affect the bottom lines of most businesses that were expecting the ERC in the fourth quarter of 2021.

As a result of the change, the credit now expires at the end of 2021, rather than the end of September. While this is a welcome change for employers, it also means that fewer businesses are able to benefit from this tax incentive.

The new legislation would allow for an additional ERC of up to $50,000 in the third and fourth calendar quarters of 2021. Businesses must pay a minimum of $100,000 in payroll during these two quarters. However, they can keep this money as a credit advancement, which they can use to help offset business expenses.

For businesses to qualify for the credit, they must have experienced a loss in gross receipts during the first or second calendar quarter of 2020 or the fourth calendar quarter of 2021. In addition, they must have an average annual gross receipts less than $1 million.

During these times of uncertainty, the ERC was designed to encourage businesses to keep their employees on the job. In addition, it helped employers meet the needs of pandemic payrolls.

However, the credit has undergone several changes since its inception. It is a refundable tax credit that is calculated based on 70 percent of the qualified wages paid during a certain period. It can be claimed by a wide range of eligible employers. To claim it, an employer must report the qualified wages on Form 941-X.