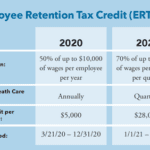

The Employee Retention Tax Credit (ERTC) is a refundable tax credit that is intended to help businesses retain their employees. While it is not known what will happen with the ERTC in 2023, businesses need to prepare for the change by understanding what they can expect. In this article, we will go over some of the changes that will affect the tax credit.

Employee Retention Tax Credit (ERTC)

Employee Retention Tax Credit (ERTC) is a program designed to encourage businesses to keep employees on their payroll. It's a fully refundable tax credit that can add thousands of dollars to a business's bottom line.

The CARES Act created ERTC, a monetary incentive to encourage companies to retain employees and avoid layoffs. Businesses may qualify for the credit by paying a payroll tax of $100,000 or more.

If the company does not pay a payroll tax, a 10% penalty will be assessed. However, if the business does pay the tax, it can keep it as a credit advancement.

Companies that qualify for ERTC can claim it in either the year the taxes are paid or the year they filed their tax return. In addition, they can receive a refund if their gross receipts are reduced. For example, a restaurant with a 20% reduction in gross receipts can get a tax credit of up to $7,000 per employee for the first quarter of 2021.

ERTC was initially available through the end of 2020. However, it was expanded twice in the past two years, so there's still time for your business to take advantage of this refundable credit.

You must file an IRS form 941-X within two years of paying your taxes. This tax form requires you to provide proof of your wages, along with information on any Paycheck Protection Program (PPP) loans you may have taken out.

You must also have proof of reduced gross receipts. For example, if you have a restaurant with 30 employees and 20 percent of your gross receipts are lost due to a shutdown, you may be able to claim up to $630,000 in tax credits in 2021.

Eligibility criteria

When it comes to ERTC, it's important to understand the eligibility criteria. Specifically, the amount of eligible wages that can be claimed. It's also important to know the deadlines for applying for ERTC.

The first thing to keep in mind is that the ERTC tax credit program is available through 2023. This means that businesses that need to take advantage of the tax incentive should apply before it expires in March of 2023.

In order to qualify, a business must have experienced a decline in gross receipts. The percentage must be at least 20%. A business with 30 employees could receive $630,000 in tax credits in 2021.

Similarly, a restaurant with a 20% reduction in gross receipts may request $7,000 in tax credits per employee. If a business has less than 100 full-time employees, they can count all paid employees during the period that the gross receipts have dropped. However, a business with more than 100 employees must apply for a safe harbor across all entities.

In order to claim ERTC, you must fill out Form 941-X. You will need to provide evidence that your qualified wages have been reduced by at least 10%.

Once you have submitted your application, it will take 16 weeks for it to be processed. While you can file your amended payroll tax return as long as you have the required documentation, you can't add extra expenses later on.

ERTC is an important tax incentive. It can help businesses re-establish themselves after the COVID-19 pandemic. However, the eligibility criteria are a little tricky. Thankfully, the IRS has released guidance to answer any unanswered questions.

The ERTC tax credit program is a valuable tool for small businesses that were impacted by the COVID-19 pandemic. With the help of this tax incentive, you can regain your post-pandemic footing.

Repayment of advance payments

If you are looking for an employee retention tax credit loan in 2023, you may want to consider an advance payment. It can help you secure funds sooner and may also make the process easier. However, you need to have some documentation in place to qualify for the advance.

The IRS has issued guidance that clarifies the rules for an advance payment on an employee retention tax credit. You may also wish to check out a dedicated funding specialist for additional assistance. These experts can help you decide whether or not an advance payment is right for you.

If you have received an advanced payment of an ERTC, you must repay it by the due date for the employment tax return you filed for the quarter in which you received it. Failure to do so will result in noncompliance penalties.

To find out if you are eligible for an advance ERTC payment, you can contact an IRS helpline. They will be able to provide you with information on your application and the steps you need to take to receive it.

An ERTC is an income tax credit that allows an employer to claim a refund against qualified wages. This credit can be claimed against up to 70% of qualified wages. A maximum of $7,000 can be claimed per employee.

As part of the CARES Act, an ERC was created to encourage businesses to keep employees on their payroll. Those eligible for the credit must have more than 100 employees. In addition, the credit is subject to certain health insurance costs.

The CARES Act was passed in March 2020 and will be in effect for the next four years. It extends the credit through December 2021.

Refund of advance payments for wages paid in the fourth quarter of 2021

The Employee Retention Credit (ERC) is a refundable tax credit that allows employers to claim a refund of qualified wages. It can be claimed for employee wages paid before October 1, 2021, or through December 31, 2021. Qualifying wages include wages paid to employees for work performed during the following calendar quarters: March 13, 2020 – May 31, 2020, and September 30, 2020 – December 31, 2020. Generally, the credit is limited to the first $10,000 of wages per employee in each quarter, and the maximum amount is $7,000 for the fourth quarter. If you are an employer, read on to learn more about the ERTC.

In the wake of the Infrastructure and Investment Jobs Act, the ERTC program has undergone some changes. Most importantly, the fourth quarter of 2021 has been eliminated, and thus, most businesses have been impacted. This change can have a significant impact on an employer's expectation to claim an ERTC in the fourth quarter of 2021. Fortunately, the IRS has provided guidance to affected businesses. These guidelines are outlined in the Notice 2021-49, and provide clarifications on the ERTC.

Under the CARES Act, the ERC was originally created as a means to encourage businesses to retain their employees, and it was expected to remain in place through the end of 2021. However, the Biden Infrastructure law changed the date of the program's end. Consequently, most employers were left vulnerable to penalties.

As a result, the IRS has issued notices in order to clarify the process for people who filed forms. These guidelines include clarifications on the definition of wages, interaction with other deferrals, and documentation requirements. If you received advance payments of an ERTC, you are required to return the funds by the due date for the applicable employment tax return. Failure to repay the advance payments can trigger penalties.

Impact of repealing ERTC on businesses

If you are a business owner, there are some changes you will want to know about when the Employee Retention Tax Credit (ERTC) goes into effect on March 27, 2020. The new legislation enables businesses to claim a refundable tax credit of up to $7000 per employee per quarter for qualified wages. However, certain restrictions apply to this credit.

To determine whether or not your business qualifies for ERTC, you will need to determine the number of employees in your company. A business with more than 500 employees would be eligible to claim the credit, but only if those employees were not working at the time the tax credit was available. It was also possible for businesses with fewer than 500 full-time employees to claim the credit.

Employers who received the advanced payment of ERTC are now required to repay the credit by the due date of the applicable employment tax return. You can find instructions on how to do this by reviewing the instructions for the applicable tax form. Regardless of whether or not your business received the advance, you must report any errors on Form 941X.

Although the ERC has gone away for most businesses, it will still be available to qualified business owners. In particular, Recovery Startup Businesses are now included in the definition of the credit. These businesses are defined by Section 3134(c)(5). They will be eligible to claim the credit if they have experienced a 20% decline in gross receipts during a single quarter.

In addition to this, if your business is a Recovery Startup, you will be eligible for the American Rescue Plan Act's Paid Leave Credit. This credit will extend the coverage to the wages paid between July 1, 2021 and December 31, 2021.