With the new federal tax code, you might want to consider taking advantage of the employee retention credit, which can be worth up to 8% of your eligible wages. This credit applies to companies that have less than 100 full-time employees. It's designed to offset the costs of hiring, training, and retaining employees.

Employers with 100 or fewer full-time employees

Employee Retention Credit is an employer tax credit that rewards businesses for keeping their employees. The credit is up to $7500 per employee and is available to most businesses. This credit is refundable. Generally, it includes the pretax portion of an employer's payroll taxes.

There are several ways to calculate the amount of credit owed by an employer. Employers must first determine the number of full-time employees and their wages. In addition, the total amount of credit will also depend on the size of the business.

Employers must file Form 941 to claim this credit. For more information, see the IRS's FAQs on Employee Retention Credit.

To qualify for the credit, an employer must have 100 or fewer full-time employees. These employers are eligible to claim the credit even during a shutdown. However, if an employer has more than 100 full-time employees, it must only use qualified wages of those employees who are not working.

If an employer has a large number of part-time employees, it can still claim the ERC. It will only be able to claim a partial credit, though. Moreover, it must only be used for additional wages that are higher than the wages paid to part-time employees.

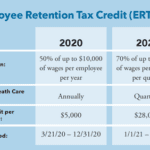

In addition, it must be verified by a competent tax advisor. Despite the fact that the eligibility standards have changed, the maximum credit remains at $10,000 per employee in 2020 and $7,000 per employee in 2021.

Nevertheless, it is possible to take advantage of this credit, especially if your business has experienced a significant decline in gross receipts. Companies that qualify for the credit are allowed to offset their payroll tax deposits with the IRS. Also, some companies may be eligible for an advance from the IRS.

Although the credit for employees is limited, it is still a valuable incentive for any business. It is not available to nonprofit organizations or governmental employers. Rather, it is a refundable tax credit that will be credited to an employer's Form 941.

In the fourth quarter of 2021, the program was terminated. However, in the third and fourth quarters of 2021, Recovery Startup Businesses were allowed to claim the credit of up to $50,000.

Qualified wages

The Internal Revenue Service recently published several FAQs regarding the Employee Retention Credit. These FAQs contain detailed information on how to claim and report this tax credit.

To claim the ERC, an eligible employer must file an amended Form 941. This form is also called a Modified Employer's Quarterly Federal Tax Return (Form 941-X). Qualified wages are any wages paid by an eligible employer to an employee during a period when the employer was not providing services. However, the IRS does not include wages paid for sick days, vacations, or any other days off.

If an eligible employer does not have enough employment tax deposits to claim the credit, it may get an advance from the IRS. It is important to consult with a tax professional before claiming the credit.

An eligible employer must have less than 501 W2 employees in the quarter. Additionally, the business must have been in operation before February 16, 2020.

The credit is available on qualified wages paid between March 12, 2020 and September 30, 2021. During this period, an eligible employer can deduct up to $7,000 per quarter for each employee. Affected employers can also use their earnings to offset payroll tax deposits, resulting in a lower tax bill.

The ERC can be used to encourage companies to keep employees during challenging economic times. In particular, it provides an incentive for companies to retain valued employees.

Among the qualifying employers are tax-exempt public hospitals, colleges, and universities. Also, it may be used for certain recovery startup businesses. Recovery Startup Businesses could take up to $50,000 in credit for the third and fourth quarters of 2021. Similarly, the Small Business Jobs Tax Credit is aimed at small businesses that are struggling to maintain a workforce.

There are several ways to calculate the credit. For instance, an employer can use the Paycheck Protection Program (PPP) to treat all or some wages as qualified wages. Alternatively, the employer can apportion the credit to members of an aggregated group. When determining the number of full-time employees, an employer must consider the average number of full-time employees for the prior calendar year.

Double-dipping

Employee Retention Credit (ERC) is a refundable tax credit for businesses that have experienced a significant decline in gross receipts. It was first introduced in the Coronavirus Aid Relief and Economic Security Act (CARES) as a means of alleviating the tax burden of small businesses.

The ERC is worth up to 70% of qualified wages per quarter for 2021. This amount is determined by a number of factors including the size of your business, the type of products and services you offer, and the benefits you provide to your employees. However, if you are an employer with more than 100 full-time employees, you are only able to use the qualified wages of those employees who are not working.

The IRS also released additional guidance on the Employee Retention Tax Credit on August 4, 2021. While this was not a significant change, it did make it possible for some companies to get the credit in the same quarter as the R&D Tax Credit. In addition, it eliminated the restriction on ERC eligibility for the 2020 tax year.

For smaller employers, the most expensive item they could claim was a one-time tax credit of up to $5,000. A smaller, but still a nice thing, is that they can now take the credit on any qualified wages, as long as they haven't already taken the credit in another calendar quarter.

Although it is not a new concept, the double-dip employee retention credit is not the only such program to be created by Congress. CARES and the American Rescue Plan Act (ARPA) created PPP loans, the SVOG (Small Business Tax Relief) program, and the RRF (Rescue Recovery Fund) programs. As a result, there has been much confusion and uncertainty about how best to implement these programs.

A double-dip employee retention credit is not the solution to that problem. There are other, better alternatives. Before taking the credit, consult an accountant or payroll specialist to ensure you don't get caught out. If you are still unsure about which of these options is the right fit for your company, contact the IRS and learn more about the ERC.

Cost

Employee Retention Credit (ERC) is a refundable tax credit. It is designed to help businesses that are struggling to retain employees. The credit provides businesses an incentive to keep employees, and can be used to offset payroll costs.

ERC is available to most businesses. However, some businesses may not be eligible to claim the credit. Whether or not your business is eligible depends on the number of employees and qualified wages.

ERC is a government stimulus program. It is administered by the Internal Revenue Service. There are several guidelines on how to claim the credit.

For example, a small employer can receive up to $500 for each employee that qualifies. This is not an unlimited amount, but it can be a great financial incentive to keep your workforce. If you have at least one new employee, you can also receive up to $10,000 in credits.

However, the credit is only available for payments made prior to October 1, 2021. This means that you can only claim the credit if you pay qualifying wages to your employees in the quarters between March 12 and September 30 of 2021.

In 2021, the maximum credit is 70% of qualified wages. This can be up to $7,000 per quarter. Qualified wages include salaries, health care costs, and other personnel expenses.

Small businesses that closed because of the COVID-19 pandemic can still qualify for the credit. However, the company must have at least one permanent full-time employee.

Businesses that have received assistance with the Paycheck Protection Program are not eligible for the credit. Additionally, family members of a business owner cannot qualify. Aprio's dedicated team of advisors have experience on both sides of the relief equation. They are experts in COVID relief policies. Moreover, they stay current on the latest news from government agencies to ensure that you are taking advantage of the best opportunities.

While the government shutdown and pandemic were difficult times for many businesses, the Employee Retention Credit helped to alleviate some of the financial strain. As a result, businesses have been able to stay open.