ERTC Tax Credit 2022

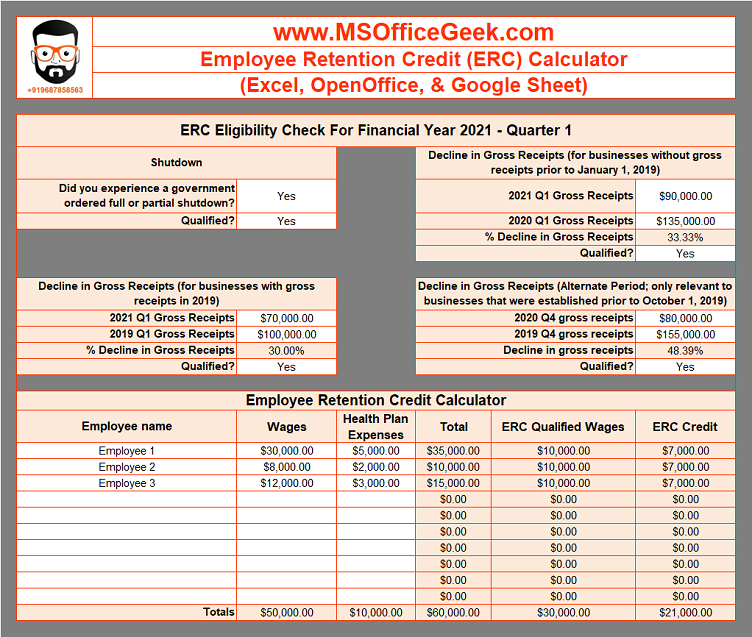

The ERCTC tax credit is an incentive that is available for eligible employers and self-employed freelancers. It allows a company to reduce their tax bill by a certain percentage of the amount of money they pay to contractors in the form of wages. However, there are certain requirements that must be met in order to […]

ERTC Tax Credit 2022 Read More »