If you are an owner of an LLC, you may be wondering whether or not you qualify for the employee retention credit. This credit is intended to encourage small business owners to hire and retain employees. In order to qualify for this credit, you must meet a number of criteria.

LLC owners do not receive qualified wages

If your business is an LLC, it's important to know whether or not you're getting qualified wages for employee retention credit. While there are no specific rules regarding owner wages for the credit, there are some general guidelines that you should be aware of. In particular, you'll need to understand how the law defines family members.

You'll also need to keep in mind that not all wage payments will qualify. For example, if you are a majority owner, you might not get any Employee Retention Credit for your earnings. However, if you're only a minority owner, you could still qualify.

The IRS has issued a new guidance addressing this question. It's called Notice 2021-49. This notice clarifies the rules for qualifying employees' wages. Specifically, the agency has outlined the rules for defining and analyzing family members.

A related individual is defined as a parent, sibling, or child. Additionally, this person must be a member of the taxpayer's household. Other related individuals include spouses, sons-in-law, or daughters-in-law.

A major shareholder is a person who owns more than half of a corporation. If you own more than 50% of a business, it's important to understand your qualification. Moreover, if you are related to another owner with more than half of a business, you may not qualify. Similarly, if you are related to a spouse, you may not qualify for ERCs.

As you can see, this new IRS guidance clarifies the rules for qualifying for ERCs. In addition, it addresses constructive ownership.

If you are an owner of an S-corporation, you are not eligible for ERCs. Similarly, if you are a spouse of an owner with more than half of a corporation, you will not be eligible.

Qualified wages can only be included if they have no living family members

The Employee Retention Credit (ERC) is a federal tax credit that can be applied to qualified wages paid by an employer. However, the credit can only be applied to wages that are not included in the employee's share of social security or Medicare taxes.

In addition, the ERC can be claimed in conjunction with the Paycheck Protection Program loan. This program provides businesses with cash to help them cope with COVID-19. Businesses that have had a significant decline in gross receipts because of the COVID-19 crisis may be eligible for ERC.

In order to qualify for ERC, the business must have at least 50% ownership. A business that is majority owned by a family member or relative will not qualify for this credit.

The IRS has released guidance relating to the ERC. One of the issues raised is the eligibility of wages for part-time employees. Previously, businesses relied on FAQ 59 for guidance on the qualification of wages. Although the IRS has provided clarification on this issue, it has left room for interpretation.

For example, let's look at a local full-service restaurant chain that averages more than 100 full-time employees. Sue Sherman owns 60% of Sherman Steers, Inc. She employs Jim Sherman. Both Jim and Sue are related to Sam. While Jim does not work for ABC Corporation, his wages do not qualify for the ERC.

If you own a business that has more than 50% ownership, you need to think about how you should approach Qualified Wages. You must consider whether or not your owner's family members are considered related individuals.

Section 267(c) of the Code deems the family members of owners to indirectly own their shares. In other words, if there is a relative that has a relationship to the owner, the owner is treated as the family member.

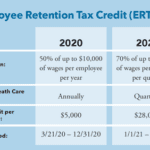

Calculating the credit

If you are a business owner or have employees who are not working for you due to economic hardship, then you may qualify for the Employee Retention Credit. This credit is a refundable tax credit that is intended to help businesses retain employees. It is also applicable to religious organizations, and can be claimed if their gross receipts have decreased significantly.

This tax credit is a revolving program that allows businesses to receive a credit of up to 50% of the cost of keeping an employee on their payroll. This can range from a few hundred dollars to thousands of dollars per employee. In order to claim this credit, you need to have accurate data and a clear understanding of how the program works.

The ERC was initially created as part of the CARES Act. Businesses that had to make changes to their operations due to the pandemic can be eligible for this credit. However, this credit may not apply to businesses that were not affected by the coronavirus epidemic.

In order to determine whether or not your business is eligible, you should contact your accountant or a qualified tax professional. They will be able to help you calculate the credit. You may also need to hire an attorney if you have any questions.

The IRS offers a variety of ways to calculate your ERC. One option is to use an online calculator. This is an easy way to get an estimate of the credit. Another method is to get a free estimate.

For a more detailed analysis, you may want to use a certified public accountant or a qualified tax professional. While the IRS website provides general information, it is best to check with them to ensure you are claiming your credit in the most effective manner.

Avoiding audit risk

For small business owners, an IRS audit can be an unwelcome distraction. Luckily, there are a few things you can do to minimize the risk. The first is to gather some evidence that you are indeed in business. Another good idea is to make sure you've got federal tax ID numbers for all your contractors. If you don't, you're in for a rude awakening if you get a surprise audit. Lastly, make sure to take a close look at your schedule. You never want to spend a tax season wondering where your time has gone.

Keeping a meticulous record of all your activities can help you answer the question, “where have you been” for months to come. Whether you're an employee, a contractor or an independent contractor, a little preparation goes a long way. It's a good idea to keep a spreadsheet of your work and travel calendars and a few well-placed business cards in the event of a surprise visit from an IRS agent. This might be the best reason to take advantage of free business cards in the mail.

A word of caution, however: if your business is too small to warrant an audit, you could end up on the wrong side of the IRS. One of the biggest risks is claiming too much money on your taxes. Make sure to be honest and upfront about your financial situation. An accountant or tax attorney will be able to guide you through this process.

With the right knowledge and a few good friends in the know, you should be able to avoid the IRS snooping around your business gizmo.