The Ertc tax credit is a special tax credit for businesses that have 100 or fewer full-time employees. It was created to encourage small business growth and provide financial help for struggling businesses. Businesses that qualify for the ERC can choose to receive either a tax refund or a PPP loan. If a company chooses to receive a refund, they will need to file IRS Form 990-T.

Employers with 100 or fewer full-time employees

Employee Retention Tax Credit, also known as ERTC, is a refundable tax credit that reduces the amount of payroll taxes an employer pays. It is designed to encourage employers to keep employees on the payroll. There is a limit on the number of qualified wages an eligible business can claim.

This is a tax credit that can be claimed by businesses with fewer than 100 full-time workers. However, this is not the only reason an eligible employer should be seeking the ERC.

The IRS has issued new guidance for claiming the ERTC. These new regulations include clarifications on the documentation requirements and interaction with other deferrals. In addition, the agency provided clarifications on the definition of wages.

During a period of suspension, an employer will be eligible for a credit for qualifying salaries. For example, if a company has been ordered to suspend operations due to a government directive, it is still entitled to the credit.

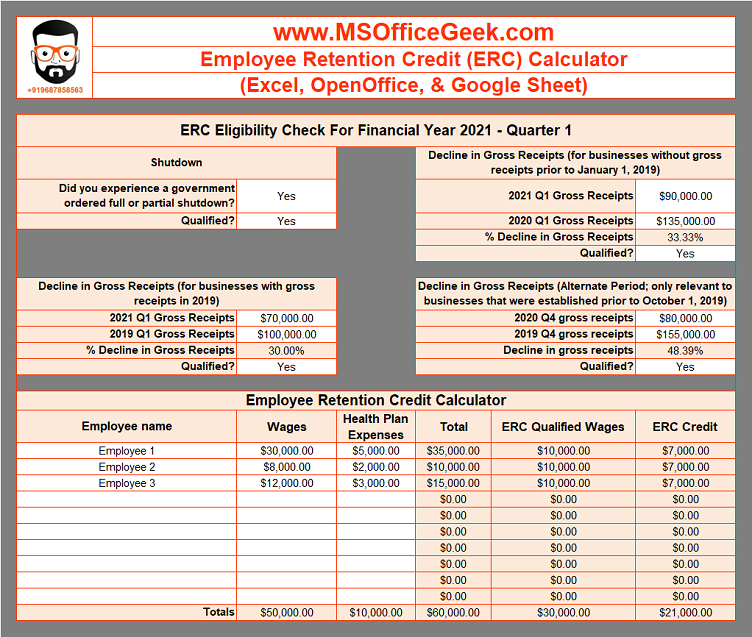

A business must experience a 20% decline in gross receipts or a drop of more than 50% in gross revenues during a calendar quarter. This type of event must be significant enough to trigger the credit.

While the ERC will be available to eligible employers until 2021, new rules have changed the qualifying standards. An employer that wishes to claim the ERC in 2021 must have a more rigorous headcount classification. Furthermore, the amount of credit available to an eligible employer may be more than what an employee normally earns.

If an employer is interested in claiming the ERTC, they should consult with a tax professional. They should also be sure to apply the safe harbor consistently across all their organizations.

An employer should also be aware that the ERTC will not be included in their gross income for federal income tax purposes. Additionally, the credit is capped at $10,000 per employee during a quarter. As such, it is important to calculate a credit with the correct number of qualifying employees.

The CARES Act expanded the eligibility of businesses for the ERTC. However, it excluded governmental employers.

Businesses that took PPP loans

Businesses that took PPP loans for Employee Retention Credit (ERC) are able to claim it retroactively, as new legislation passed in December allows them to do so. This relief package provides additional economic relief to struggling businesses that are recovering from the COVID-19 pandemic. It also opens up new categories of expenses to be forgiven.

Until this time, only self-employed individuals and businesses with fewer than 500 employees could claim the credit. However, the American Rescue Plan Act of 2021 expanded the credit to small businesses and added internet publishers and nonprofit organizations to the list.

The IRS has released some guidance about claiming the credit. It is important to understand how the program works. Some of the details can be confusing. Luckily, there are experts who can help you figure out if your business is eligible.

To qualify for ERC, businesses need to demonstrate that their operations were interrupted due to government orders. They must also be paying at least 60% of their payroll costs. If they are unable to meet this threshold, they can amend their loan amount by taking into account their gross revenue.

The refundable amount of the credit has increased from 50% of qualifying wages in 2020 to 70% in 2021. For example, the refundable portion of the credit may be as high as $10,000 for each employee.

To determine if you are eligible for the credit, review your wage reports and pay attention to the nonpayroll costs. These may play a big role in your forgiveness calculations.

Before applying for PPP loan forgiveness, your business should analyze the wages it pays to its employees. If they are qualified wages, they can be claimed for PPP loan forgiveness. You can then use those funds for other business activities such as rent or mortgage interest.

The ERC may be a free tax deduction, but your business will still have to file quarterly tax returns and show how it spent the money. As such, it is important to be aware of all available financial assistance programs.

Companies that were completely or partially shut down

The Employee Retention Credit (ERC) can be claimed by companies that have completely or partially shut down their operations. This credit can be as high as $21,000 per employee. Employers must qualify for the ERC by following certain requirements.

To qualify, a business must have experienced a drop in gross receipts during a calendar quarter. Gross receipts must be at least 20% less than the previous year. It is also important to remember that the ERC is only valid for the quarter that the company was closed.

If the company is eligible, it can file an amended payroll tax return. This will reduce payroll taxes on the employees. However, there is a limit on how many employees can qualify for the credit. In 2021, this limit is $10,000.

Businesses that qualify for the ERC should appeal for a safe haven at all institutions. Often, businesses that have experienced partial shutdowns can continue their operations through telework.

A small business is defined as an employer with 500 or fewer full-time workers. Employment figures for 2019 are used to determine this. While a company's operations may be shut down, it will still qualify for the ERTC if it has no more than 100 full-time employees.

To qualify for the ERC, the business must have an annual gross sales of $1 million or less. There are a few exceptions to the standard qualifications.

The CARES Act is a bill that enacted the Employee Retention Credit. This relief measure is a payroll tax credit for employers that have experienced a decline in their revenue. Companies are eligible for the credit if they have experienced a reduction in their gross receipts by 50% in 2020 or 20% in 2021.

If a business qualifies for the ERC, it must continue its operations in 2021. The statute of limitations is three years from the date the employer filed the ERC application.

During a pandemic, it is critical that essential businesses remain open. Some of these include medical providers, food service establishments, and lodging services. If the pandemic disrupts supply and demand for these types of services, a business may qualify for the ERC.

Worker Retention Credit scores

The Coronavirus Aid, Relief, and Economic Security (CARES) Act created the Employee Retention Credit. This refundable tax credit provides a temporary financial incentive for employers to retain workers during times of economic hardship. Currently, the credit is equal to 50 percent of the total qualified wages paid by the employer to eligible employees.

Businesses may claim the ERTC for their qualified wages paid during the first three quarters of 2021. The maximum credit available for an eligible company is $21,000. However, the credit will expire on October 1, 2021.

CARES provides businesses with the financial incentive they need to keep their valuable employees. Depending on the size of the business, the amount of the credit can vary. For example, restaurants can claim a $7,000 credit for each employee in the first three quarters of 2021.

To qualify for the ERTC, an eligible company must have 500 or fewer average full-time employees. In order to receive a credit, a firm must also pass two exams. If the company is a startup that has been rescued by the American Recovery and Reinvestment Act, special requirements apply.

Businesses can apply for a federal advance payment from the IRS for significant expenses incurred during the recovery of the business. Likewise, the government can issue an advance payment for the employee retention credit. There are attribution rules that apply to owner/spouse wages.

Employers who qualify for the ERTC are required to file Form 941-X, a quarterly federal tax return. It is also a good idea to consult an experienced tax planner to ensure that you are claiming the correct amount of credit for your business.

The IRS estimates that a claim for the ERTC can take six to ten months to process. During this time, a firm must retain records of its grant usage.

ERC Today is a website that can help companies evaluate their eligibility. They offer program expertise, a thorough analysis of claims, and interpretation of multiple states' executive orders. Also, they can help companies understand the aggregation rules for larger employers.